Turnover of the First Nine Months of the 2021/2022 Financial Year

Continuation of the Group’s Transformation Plan Despite an Uncertain and Inflationary Environment

Damartex closed the third quarter with sales of € 173.0 Mn, down -11.3% at actual exchange rates (down -12.5% at like for like exchange rates) compared with the third quarter of the previous financial year. The Group’s business is suffering from record inflation, particularly in the UK and Germany, leading to a contraction in consumption. The base effect is also unfavourable: the third quarter of 2020/21 saw a strong recovery in demand, with, as a reminder, a +20.8% growth in turnover compared with €162.1 Mn in the 3rd quarter of 2019/20.

Building on a customer base that had been built up with 1.4 million new customers in the first half of the year, Damartex added 525,000 new customers in the third quarter. This is a slowdown compared to the third quarter of 2020/21 but an increase of 25,000 new customers compared to the same quarter pre-covid.

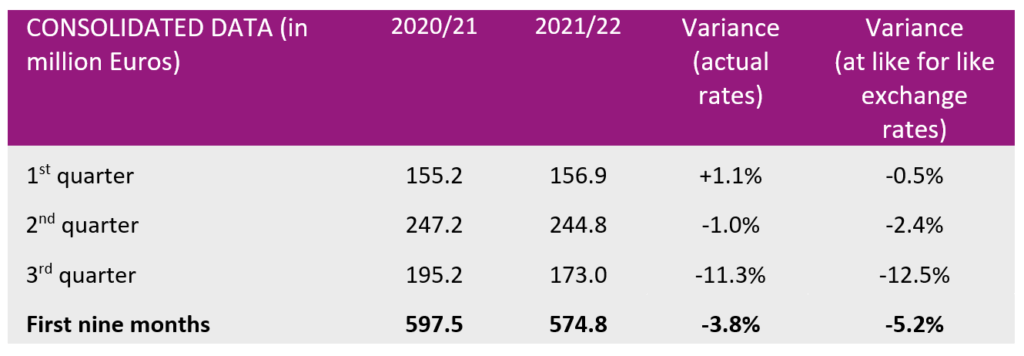

For the first nine months of the financial year, Damartex’s sales were down by -3.8% at actual exchange rates (-5.2% at like for like exchange rates) to € 574.8 Mn.

Sales for the “Fashion” division came to €432.7 million for the first nine months, stable against the last financial year (-0.8% at actual exchange rates, -1.9% at like for like exchange rates). In the third quarter, sales shrunk by -7.5% at actual rates (-8.6% at like for like exchange rates).

Over the quarter, the Xandres brand performed well, with very strong growth of +44.6% at actual and like for like exchange rates, driven in particular by the dynamic Belgian market and the brand’s positioning. Arbitrage on consumption impacted Damart and Afibel, respectively down -8.7% at actual rates (-10.0% at like for like exchange rates) and -12.6% at actual and constant rates over the quarter.

Sales for the “Home & Lifestyle” division came to € 117.2 Mn, down by -15.0% at actual exchange rates (-17.0% at like for like exchange rates) over the first nine months. Sales for the third quarter amounted to € 37.0 Mn, (-24.2% at actual exchange rates, -25.6% at like for like exchange rates).

This decline is explained in particular by the impact of inflation in the United Kingdom, which is at its highest level since the 1990s, on the Coopers of Stortford brand, and the strong base effect compared with the previous financial year. The company recorded a drop of -34.4% at actual rates over the quarter (-37.3% at like for like exchange rates), particularly marked on a very strong decline in e-commerce in the sector.

Finally, the “Healthcare” division, which includes the Sedagyl, Santéol and MSanté brands, reported sales of €24.9m, confirming the good momentum of the business with growth of +5.5% at actual exchange rates over the first nine months (+4.5% at like for like exchange rates). For the quarter, the business stabilized at +0.3% at actual exchange rates (-0.5% at like for like exchange rates) with sales of € 8.2 Mn.

Outlook

The deteriorated economic environment is prompting the Damartex Group to accelerate its development and pursue the transformation actions that are part of its Transform to Accelerate 2.0 strategic plan.

The Group is not directly exposed to the Ukrainian conflict. However, in this geopolitical context, which is likely to affect the global economy and accentuate inflation and supply tensions over the coming months, the Group anticipates a negative impact on its results and remains cautious as to the evolution of the situation.