Turnover of the 2nd Quarter of the 2020/2021 Financial Year

Performance in line with the transformation plan

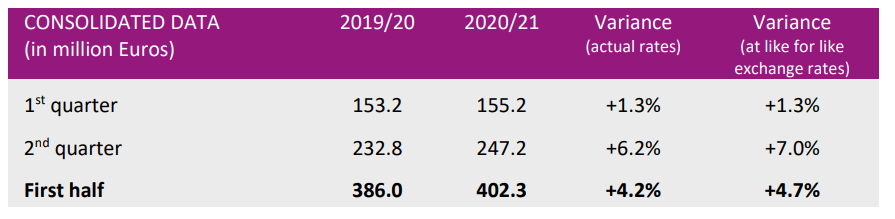

Damartex ended the first half of the 2020/2021 financial year with sales of € 402.3 million, up +4.2% at actual exchange rates (+4.7% at like for like exchange rate). Second-quarter sales rose sharply by 6.2% at actual exchange rates to € 247.2 million. (+7.0% at like for like exchange rate).

The Group experienced sustained growth, the first visible effects of the

implementation of the “Transform to Accelerate 2.0” (TTA 2.0) plan. This growth was driven in particular by the strong increase in e-commerce (+54.2% at actual exchange rates over the half year) and the increase in mail order sales. Both channels benefited from a circumstantial “Covid” effect, but this change in consumption patterns is more of an acceleration than a transitory effect.

The retail channel, on the other hand, experienced a slowdown in sales during periods of lockdown. Following the relaxation of these measures in its main markets, Damartex benefited from a strong recovery inconsumption in December 2020.

Sales for the “Fashion” division came to € 297.8 million for the first half of the year, a slight increase of +.6% at actual exchange rates (+1% at like for like exchange rate), driven in particular by a +2.6% increase in sales at actual exchange rates in the second quarter (+3.3% at like for like exchange rate).

Over half year, Damart brand sales rose by +1.5% at actual exchange rates.

(+2.0% at like for like exchange rate) driven by the excellent performance of

mail, particularly in France and the United Kingdom. Sales in Belgium were

nevertheless significantly impacted by the closure of stores, which remain the main distribution channel.

Afibel’s activity was down -3.7% at actual rates. This downturn is in line with expectations and reflects the initial output of the strategic repositioning, the full effects of which is expected by the Group in the coming seasons.

The “Home & Lifestyle” division continued its solid growth with sales of € 89.1 million, up +12.2% at actual exchange rates (+13.0% at like for like exchange rate). Second-quarter sales came to € 53.2 million, up sharply by +14.4% at actual exchange rates. (+15.8% at like for like exchange rate).

Over the half year, Coopers of Stortford, a brand present exclusively in the

United Kingdom, recorded a +59.0% increase in sales. (+63.1% at like for like

exchange rate). This over-performance is the result of the continued renewal of its range, digital acceleration and a supply closer to its markets allowing for greater responsiveness.

The 3Pagen and Vitrine Magique brands, whose sales in the 1st quarter were hindered by a delay in the sales plan, rebounded strongly in the 2nd quarter and posted +5.0% growth at actual exchange rates in the first half.

The “Healthcare” division, posted first-half sales of € 15.4 million, up +47.3% at actual exchange rates. (+48.1% at like for like exchange rate). This increase is explained by the integration of Santéol, whose activity is in line with the Group’s objectives, as well as by the good performance of Sédagyl, which posted strong growth of +8.3% at real rates (+8.8% at like for like exchange rates).