Turnover of the 2021/2022 financial year

Progress of the TTA 2.0 Transformation Plan Slowdown in Business in an Inflationary Context

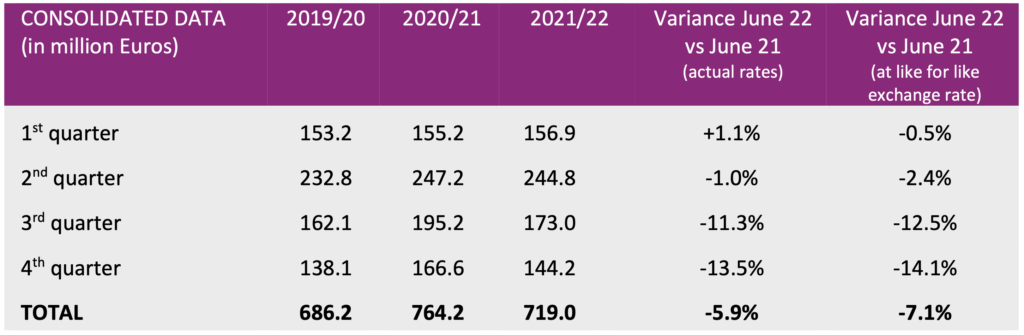

Damartex closed the 2021/2022 fiscal year with sales of €719.0 million, down -5.9% at actual rates compared with the previous year (-7.1% at like for like exchange rates), impacted by a difficult economic context. After a stable first half compared with the previous year, the Group posted revenues of

€317.2 Mn in the second half of the year, suffering from a slowdown in sales of -12.3% at actual rates (-13.2% at like for like exchange rates) against the same period last year.

Damartex continues to strengthen its customer base, which was enhanced by 1.4 million new customers in the first half of the year, by adding 0.8 million new customers in the second half of the year, including 0.3 million in the fourth quarter.

In the fourth quarter, business fell significantly, particularly affecting the “Fashion” and “Home & Lifestyle” divisions. Despite a good performance in “Healthcare”, driven in particular by the dynamism of recent acquisitions, the quarter closed at €144.2 Mn, down -13.5% (-14.1% at like for like exchange rates).

Sales for the “Fashion” division amounted to € 535.5 Mn over the 2021/2022 financial year, down -3.5% at actual exchange rates. This division has seen strong growth in stores (+23.8% compared with last year). The revenue level observed for this sales channel is also up +19% compared with 2019/2020.

Damart remained robust in the face of the economic situation, but suffered a slight decline of -2.4% at actual rates over a year marked by the slowdown in the traditional “mail order” channel, while Afibel recorded a decline of -8.9% at actual rates. Benefiting from its positioning in the affordable luxury segment, Xandres posted record performances in Belgium and the Netherlands, representing an increase of +20.4% at actual exchange rates.

The “Home & Lifestyle” division was particularly affected by the deterioration in the macroeconomic environment, and posted revenues of €147.6 million, down -16.9% at actual exchange rates over the year (down -18.6% at like for like exchange rates). The sales of the three banners suffered from a very unfavourable base effect on e-commerce, which had benefited from the health crisis.

Lastly, sales for the “Healthcare” division, which includes the Sedagyl, Medical Santé, Santéol and MSanté banners, amounted to €35.9 million, up significantly by +14.3% at actual exchange rates and +13.4% at like for like exchange rates. This good momentum in the Healthcare division continues to be reinforced by recent acquisitions, perfectly in line with the TTA 2.0 transformation plan.

Santéol, a home healthcare provider specializing in respiratory assistance, continued to grow at +18.4% at actual rates in FY 2021/22, while Sédagyl, an marketplace for home care, recorded a decline of -9.2% at actual rates, negatively impacted by the Covid base effect.

Despite a deteriorated macroeconomic and geopolitical environment, Damartex is continuing to deploy its strategic plan: Transform to Accelerate 2.0 to support its development while coping with persistent tensions on supplies. The Group is exercising caution by remaining extremely agile with regard to the rapid evolution of the economic environment, and anticipates, as mentioned at the time of the publication of the third quarter revenues, a negative impact on the annual results of the 2021/2022 fiscal year.