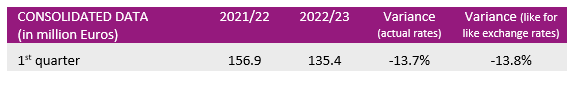

Turnover of the 1st quarter of the 2022/2023 Financial Year

Group Agility in a Still Deteriorated Economic Environment

In the first quarter of the 2022/2023 Financial year, the Damartex Group’s revenues amounted to €135.4 Mn, down -13.7% at actual exchange rates compared with the 1st quarter of 2021/2022 (-13.8% at like for like exchange rates).

Over this period, the Group recruited 302,000 new customers. This compares to 415,000 new customers in the same quarter last year.

In general, the Group’s activity was negatively influenced by a difficult economic environment: purchasing power crisis, geopolitical uncertainty, death of the Queen in the United Kingdom, etc.

Sales for the “Fashion” division came to €101.5 Mn for the quarter, down ‑13.2% at actual exchange rates (-13.3% at like for like exchange rates). Despite strong sales in stores, Damart posted a -13.8% drop in turnover at actual rates, which was affected by the temporary closure of websites this summer following a cyber attack. Afibel closed the quarter with revenues down -22.1% at actual exchange rates, while Xandres continued its good performance with a significant +17.8% increase in revenues over the period. The “Home & Lifestyle” division, marked by a “post-covid” contraction in the consumption of home & garden items, recorded sales of €22.7 Mn in the first quarter, down -28.5% at actual and like for like exchange rates. The Coopers of Stortford, 3Pagen and Vitrine Magique brands recorded a decline of ‑26.8%, ‑32.9% and -17.4% respectively at actual rates.

Finally, the “Healthcare” division, which includes the activities of Santéol, MSanté, Sédagyl and Médical Santé, recently acquired, recorded strong growth of +35.0% at actual exchange rates, with revenues of €11.2 million.

It was driven in particular by the healthcare services business with MSanté, and by the solid performance of Santéol, which showed very strong growth of +60.5% over the period.

In this 1st quarter, Damartex confirms the dynamism of its “Healthcare” division, recently reinforced with the acquisition of Icelus Medical, and the solid fundamentals of its “Fashion” division to evolve in a still deteriorated economic environment.

The Group remains agile to respond to it. Current sales of Thermolactyl products by Damart, as a result of the return of cold weather, are an illustration of this, even if they alone cannot predict the general trend of Damartex’s activity.

The Group remains cautious about the rapid and uncertain evolution of the macroeconomic situation.