Turnover for the 2nd quarter of the 2022/2023 financial year

Agility and Strong Fundamentals in a Still Challenging Environment

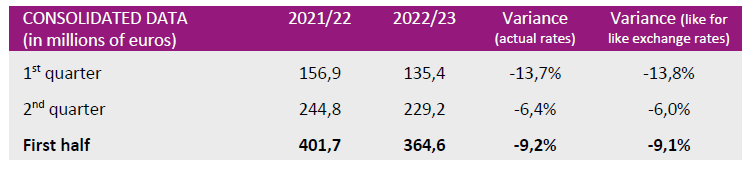

Damartex ended the first half of the 2022/2023 financial year with sales of €364.6 Mn, down on the previous year (-9.2% at actual exchange rates, -9.1% at like for like exchange rates). In a context marked by inflation and the decline in purchasing power, sales amounted to €229.2 Mn, down -6.4% in the second quarter (-6.0% at like for like exchange rates).

The slowdown in the UK market is becoming more pronounced and is impacting the Group’s brands in this region.

Damartex also continues to recruit customers: + 700,000 new customers over the last quarter (down -28% compared with last year).

Sales for the Fashion division totalled € 284.9 Mn for the first half of the year, down -6.6% at actual exchange rates (down -6.4% at like for like exchange rates). Second-quarter sales were slightly down by -2.4% at actual exchange rates (-2.2% at like for like exchange rates).

Damart remained stable over the 2nd quarter compared with the previous financial year: in contrast to the UK market, where consumption is stagnating, Damart performed well in France and Belgium, particularly in terms of sales in stores.

Afibel ended the quarter down -27.7% at actual rates. Xandres continued to perform well and ended the second quarter with a very strong increase of +56.5% at actual rates.

The Home & Lifestyle division, still affected by a contraction in post-covid consumption in the home equipment sector, closed the half-year with sales of €58.1 Mn, down -27.6% at actual rates (-27.2% at like for like exchange rates). The downturn in consumer spending in the German and UK markets, which began in the 1st quarter of the year, again weighed on 3Pagen and Coopers of Stortford sales in the 2nd quarter, down -29.7% and -21.4% respectively at actual exchange rates.

The Healthcare division, dedicated to the healthcare business and recently strengthened, continues to grow, posting a strong increase in turnover of +29.8% at actual exchange rates in the first half of the year, reaching €21.6 Mn (+30.1% at like for like exchange rates).

Second-quarter sales amounted to €10.5 Mn, up sharply by +24.7% at actual rates (+25.2% at like for like exchange rates). The division was driven in particular by the very good performance of Santéol, which posted strong growth of +59.8% over the period.

Damartex demonstrates its strong capacity to adapt and remains confident in its diversification strategy through its three divisions, which will remain a strength for the coming quarters.

In a market environment marked by strong uncertainty, particularly in the UK market, caution and fine-tuned steering will continue to guide the Group in the coming months.