Sales for the 2022/2023 Financial Year

A Continued Momentum of Agility Against a Still Deteriorated Backdrop.

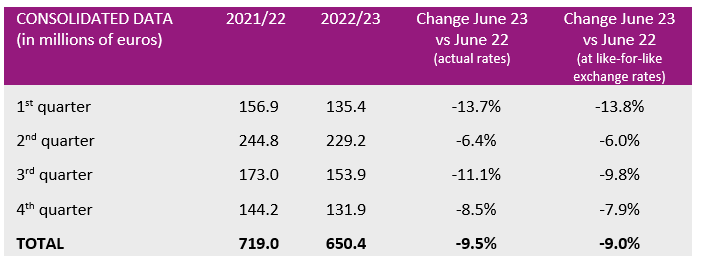

Damartex ended the 2022/2023 financial year with sales of €650.4 Mn, down against the previous year (-9.5% at actual exchange rates, -9.0% at like-for-like exchange rates), still impacted by the unfavourable macroeconomic environment and the contraction in consumption observed in certain markets, particularly the UK. After a first half down on the previous year, the Group posted sales of €285.8 Mn in the second half, down -9.9% at actual exchange rates (down -8.9% at like-for-like exchange rates).

In the fourth quarter, business slowed again, particularly in the Fashion and Home & Lifestyle divisions. Despite a Healthcare division boosted in particular by the excellent performance of Santéol, Damartex closed its final quarter at €131.9 Mn, down -8.5% at actual exchange rates (down -7.9% at like-for-like exchange rates).

Sales for the Fashion division totalled € 498.4 Mn for the 2022/2023 financial year, down -6.9% at actual exchange rates (-6.5% at like-for-like exchange rates). Despite buoyant in-store sales, which rose by +8.7%, the Damart brand posted a -5.9% decline in sales at actual exchange rates, affected in particular by a fall in mail-order sales and, more generally, consumer spending. Afibel posted sales down -21.8% at actual exchange rates. Driven by its brand positioning, Xandres continued to enjoy sustained growth, with sales up by a substantial +22.3% at actual exchange rates over the full year.

The Home & Lifestyle division continued to be severely affected by the deterioration in the macroeconomic environment, posting sales of

€ 111 Mn, down -24.8% at actual exchange rates over the financial year (-23.9% at like-for-like exchange rates).

Lastly, the Healthcare division posted sales of €41.1 Mn, up +14.3% at actual exchange rates and +14.7% at like-for-like exchange rates. Driven by Santéol, a homecare provider specializing in respiratory assistance, which posted growth of +51.5% at actual exchange rates over the 2022/2023 financial year, the Healthcare division turned in a fine performance over the year as a whole, confirming its relevance.

Outlook

In a degraded economic and commercial environment that continues to have a negative impact on sales, Damartex continues to demonstrate agility and rigour in the management of its activities, costs and cash flow, as demonstrated by the signing of an agreement on the restructuring of its current financial debt and the securing of new financing1 .

In view of the current situation, the Group anticipates an impact on its results and profitability for the financial year ending 30 June 2023, as detailed in the press release on the refinancing agreement1 .

At its annual results presentation on 6 September 2023, Damartex will unveil its new strategic plan to support the Group’s development.

1See the press release on the refinancing agreement published today and available on the Damartex website.