Results for the 2020-2021 financial year

A Strong Financial Performance

Helping Accelerate the Transformation

ACTIVITY

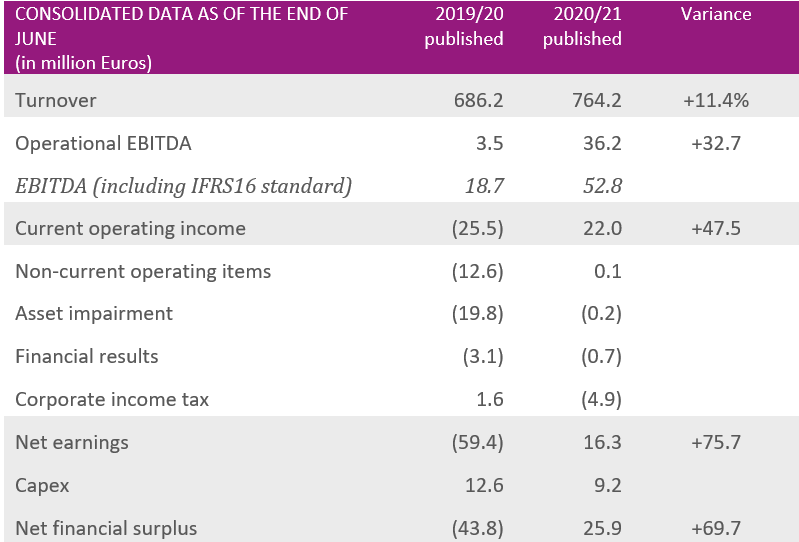

The Damartex Group closes the 2020/2021 financial year with a turnover of

€ 764.2 million, up 11.4% at real exchange rates compared to the previous financial year, thanks to a definite recovery in activity driven by the effects of the transformation plan initiated by the Group, despite the continuing health crisis.

The “Fashion” division thus recorded sales of €555.1 million, up +11.0% at actual exchange rates, while the “Home & Lifestyle” business grew by +8.3% at actual exchange rates to €177.7 million, thanks in particular to a particularly dynamic second half of the year. The “Healthcare” division, which includes the Sédagyl and Santéol brands and was recently strengthened with the acquisition of MSanté in July, has grown by +42.1% at actual exchange rates to €31.5 million.

RESULTS

As a result of this strong growth in business, the Group’s operating EBITDA reached a record level of €36.2 million, i.e. nearly 5% of the turnover.

The operating EBITDA for the “Fashion” business came to €+17.0 million, demonstrating a strong momentum of recovery. The “Home & Lifestyle” division posted an operating EBITDA of € +14.6 Mn, while the “Healthcare” division posted an operating EBITDA of € +4.6 Mn.

The current operating income (ROC) was positive at €+22.0 million over the year, thanks to the strong performance of the divisions, all of which were profitable during the year.

This significant performance was driven by the significant improvement in the business combined with the Group’s operational excellence, which was further enhanced by its transformation plan. Despite significant commercial investments to recruit new customers and strengthen the positioning and differentiation of its brands, Damartex benefited from the optimization of marketing costs and the control of its distribution costs.

Indirect costs, on the other hand, increased due to the transformation plan and the arrival of new talent in the digital, product creation and marketing teams.

The Damartex group closes the year with a net result of €+16.3 Mn.

FINANCIAL POSITION

As of the end of June 2021, the Group’s net financial surplus was €+25.9 million, compared with a net financial debt of €-43.8 million at the end of June 2020. This return to positive territory was made possible by a marked improvement in internal financing capacity (€+33.9 Mn), as well as by the capital increase carried out in October 2020 (€+33.5 Mn). In addition, the Group continues to improve control of its need for working capital, which decrease of €-8.5 Mn as of 30 June 2021.

DIVIDENDS

Given the Group’s solid performance and its medium-term trajectory, the Management Board will propose to the Annual General Meeting scheduled for 18 November 2021 the distribution of a dividend of €.40 per share.

OUTLOOK

The “Transform To Accelerate TTA 2.0” plan implemented by the Group has demonstrated its effectiveness in a troubled health and economic context. While the Group benefited from a favourable base effect, the current financial year above all reflects the Group’s renewed ability to generate profitable growth. Despite an uncertain environment that calls for caution, the Group is confident that its agility and solid financial structure will enable it to maintain this momentum.