Revenue for the 2023/2024 financial year

Damartex is pursuing its strategic course and agile management of its activities to achieve a successful turnaround

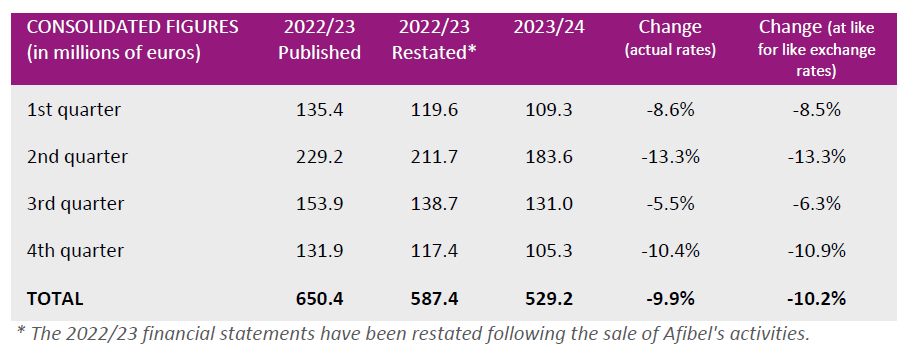

Damartex closed the 2023/2024 financial year with revenue of €529.2 Mn, down on the previous year (-9.9% at actual exchange rates, -10.2% at constant exchange rates). Continuing the trend of the first six months, second-half sales came to €236.3 Mn, down -7.7% at actual exchange rates (-8.4% at like for like exchange rates). This reflects both a business impacted by headwinds – macroeconomic and political instability and contraction in consumption – but also more targeted commercial investments.

The fourth quarter was particularly constrained for the Fashion and Healthcare divisions, while sales in the Home & Lifestyle division tended to stabilise. Damartex closed its final quarter with revenue of €105.3 Mn, down -10.4% at actual exchange rates (-10.9% at like for like exchange rates).

The “Fashion” division posted revenue of €396.2 Mn for the 2023/2024 financial year, down -9.0% at actual exchange rates (-9.3% at like for like exchange rates). With sales down -10.2% at actual exchange rates, the Damart brand was penalised by a drop in consumption, in particular due to poor weather conditions in the last quarter impacting the entire textile sector. The Xandres brand continued to prove its potential and the relevance of its positioning, with sales up +6.8% at actual exchange rates for the year as a whole.

The “Home & Lifestyle” sales for the year came to €99.2 Mn, down -10.6% at actual exchange rates (-11.1% at like for like exchange rates). While the 3Pagen brand is holding steady, Coopers of Stortford’s activity is down, in a context of persistent economic and political tensions in the English market. The Group has significantly restructured the division’s business model to meet the challenges of a generally degraded market and changes in the sector.

Finally, Healthcare revenue was €33.7 Mn, down -17.9% at actual exchange rates and -18.0% at like for like exchange rates. Santéol, a home healthcare provider specialising in respiratory assistance, closed a very dynamic financial year with revenue up +9.0% at actual exchange rates compared to the previous year. In addition, the division was particularly impacted by the underperformance of catalogue sales of homecare accessories under the Almadia brand. Faced with this challenge, the Group is looking into the possibility of discontinuing catalogue sales and reorganising the brand to focus its investments on the pharmacy and point-of-service channels.

Prospects

In a market environment that is still turbulent and given the many economic uncertainties, Damartex is maintaining rigorous cash management and careful and prudent management of its activities. While the Group continues to work on improving its operating profitability, it nevertheless expects a net profit for the year impacted in particular by exceptional items.

At its annual results presentation on September 11, 2024, Damartex will unveil the second part of its Dare.Act.Impact 2026 plan.

Damartex continues to implement its strategic plan with determination

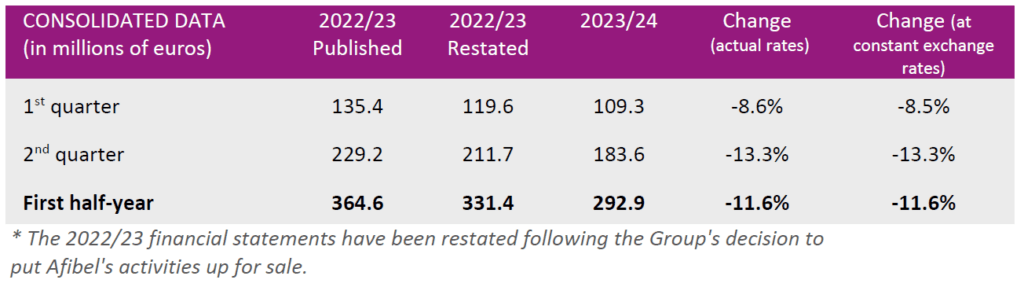

Despite sales of €292.9 million in the first half of 2023/2024, down 11.6% on the same period last year, Damartex is determined to stay the course by optimizing its fixed and variable costs, and actively managing its cash flow and working capital requirements.

Focused on customer satisfaction, the Group continues to invest in its growth and value creation objectives, and in an environment that remains uncertain, is beginning to see the fruits of its efforts.

Damartex continues to roll out its strategic plan with determination

BUSINESS

Damartex ended the first half of the 2023/2024 financial year with sales of €292.9 Mn, down on last year (-11.6% at actual and like-for-like exchange rates).

Sales for the Fashion division came to €226.7 Mn for the first half, down ‑9.9% at actual and like-for-like exchange rates, reflecting the impact of the deteriorated environment, despite another good performance from the Xandres brand (up +13.2% year-on-year).

The Home & Lifestyle division posted sales of €49.4 Mn, down -14.8% at actual and like-for-like exchange rates. This performance is currently being impacted by a commercial investment policy which is giving priority to a return to profitability, and by a market which is in decline as a result of a different trade-off in household consumption.

Finally, the Healthcare division ended the half-year with sales of

€16.8 Mn, down 22.4% at actual and like-for-like exchange rates. This figure reflects a mixed performance, with growth in the Home Healthcare sector (Santéol up +7.5% and MSanté up +3.1%) and a sharp fall in the Age-in-place sector (mainly due to a transition period dedicated to operational integration within the new Almadia entity).

DARE.ACT.IMPACT.2026 STRATEGIC PLAN

RESULTS

In an economic environment that remains unfavourable, the priority for the first half of the year was the implementation of the four-pronged DARE.ACT.IMACT.2026 plan.

Delivering financial performance:

Significant initial progress has been made in this area, with the aim of returning the business to profitability:

- Significant reduction in fixed costs with the implementation of the restructuring plan announced in September, which is already generating savings of €6 Mn on an annual basis ;

- Proactive management of inventories, both upstream (procurement) and downstream (clearing), resulting in a €20.4 Mn reduction over the first six months of the year ; and

- Optimization of marketing efficiency, thanks to better-targeted spending, resulting in a €12 Mn reduction over the half-year and an improvement in ROI.

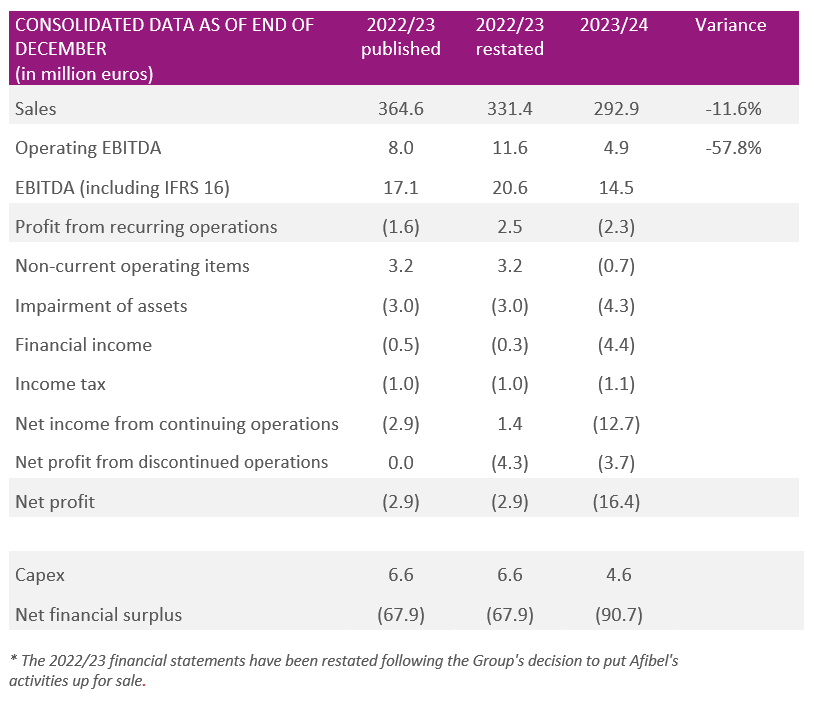

The Group’s operating EBITDA came to €4.9 Mn, against €11.6 Mn last year, mainly as a result of the fall in business over the period.

Operating EBITDA was €6.8 Mn for the Fashion division, €-2.1 Mn for the Home & Lifestyle division and

€ 0.1 Mn for the Healthcare division.

Damartex closed the half-year with a net loss from continuing operations of €-12.7 Mn, against €1.4 Mn for the 1st half of 2022/2023.

Innovative brand experience:

Damartex is pursuing its objective of modernizing the image of its brands and improving the customer experience. The effectiveness of its investments is already being felt, as demonstrated by the significant rise in its NPS from 34.9 in Autumn-Winter 2022 to 48.5 in Autumn-Winter 2023.

In addition, the hybridization of the business model is continuing, with sales on marketplaces up +14.4% to €4.8 Mn in the first half.

Change Our World:

At the core of our business model, the Group is accelerating its CSR commitments, with significant progress in the proportion of products with a limited impact*, which, for the Fashion division, rose from 21.9% in SS23 to 37.2% in AW23.

Shared Leadership:

In line with its values and its transformation culture based on trust and responsibility, the Group has launched the Leadership Development Programme, which has already reached 30% of the Executive Leadership Team.

FINANCIAL POSITION

The net financial position was €-90.7 Mn as of the end of December 2023 (compared with €-81.9 Mn at the end of June 2023), reflecting the Group’s investments and its effective, reinforced management of inventories to adapt flexibly to changes in demand.

Working capital requirements stood at €33.3 Mn at the end of December 2023, compared with €40.6 Mn last year.

In line with its intention to focus its efforts and investments on a more limited number of brands, the Group has sold Afibel, its plus-size fashion brand.

OUTLOOK

Damartex is determined to continue optimizing its fixed and variable costs and actively managing its cash flow and working capital requirements.

Focused on customer satisfaction, the Group is continuing to invest in its growth and value creation objectives and, in an environment that remains uncertain, is beginning to see the fruits of its efforts.

* For the Fashion division, a product is considered to have a limited impact if it contains at least 30% more sustainable or labelled fibres, if its manufacturing process is more resource-efficient, or if it is produced in a European country with a low-carbon energy mix.

Damartex announced today that it has signed an agreement to sell Afibel, its Golden Age brand and pioneer in plus-size fashion, to CTFI, a group specializing in the manufacture and distribution of personal and household goods.

This sale is part of the new strategic plan of the Group: Dare. Act. Impact. 2026, announced in September 2023, to enable the Group to focus its efforts and investments on a more limited number of brands.

The transaction, which preserves jobs at the Villeneuve d’Ascq site, was subject to the usual consultation procedures with employee representative bodies, and was approved by the Lille Métropole Commercial Court on February 14, 2024.

Messrs COHEN commented: “The CTFI Group is delighted to have finalized the acquisition of Afibel, a major player in ready-to-wear home shopping. With the support of the seller Damartex, this acquisition will enable CTFI to expand its brand portfolio. Synergies with the group’s other companies will offer new opportunities for growth and development, while maintaining our commitment to excellence and customer satisfaction. Groupe CTFI is delighted with this strategic acquisition and looks forward to working with Christine Bocquet, Afibel’s Managing Director, and all the company’s employees.”

Patrick Seghin, Chairman of the Damartex Board of Management, added: “The sale of Afibel is an important step towards our objective of refocusing the portfolio to which we are committed as part of our new roadmap, and represents an opportunity for the brand to pursue its development while benefiting from the expertise of CTFI’s teams. This transaction also demonstrates the Group’s active and rigorous management in implementing its strategic orientations aimed at delivering on its financial commitments”.

Business in Line with Previous Quarters, First Steps in Rolling Out the New Strategic Plan

Damartex closed the first half of the 2023/2024 financial year with sales of €292.9 Mn, down -11.6% on the previous year at like-for-like and actual exchange rates. Against a resolutely unstable backdrop of persistently high inflation, declining purchasing power for both households and businesses, and weak economic growth, second-quarter sales came to €183.6 Mn, down -13.3% at like-for-like and actual exchange rates. The UK market in particular continued to slow down significantly, impacting the Group’s brands in this region.

In a declining market undergoing radical transformation, the Fashion division posted sales of € 226.7 Mn for the first half, down -9.9% at both actual and like-for-like exchange rates. Second-quarter sales were down -12.3% at actual exchange rates (-12.4% at like-for-like exchange rates).

The Damart brand reported a -13.1% fall in sales for the quarter at like-for-like and actual exchange rates compared with the same period last year. This trend is explained by the fall in footfall, as observed in the apparel market.

Xandres, positioned as an “affordable luxury” brand, once again put in a fine performance in the quarter, with sales up +9.0% at actual and like-for-like exchange rates.

The Home & Lifestyle division, impacted by a sector suffering from a loss of confidence and household budget cuts, ended the quarter with sales of €29.4 Mn, down -16.8% at actual exchange rates (down -16.9% at like-for-like exchange rates). Sales at 3Pagen and Coopers of Stortford, which are sensitive to the economic climate, ended the second quarter with sales down by -16.3% and -17.3% respectively at actual exchange rates.

The Healthcare division, which includes Almadia, Santéol and MSanté, posted second-quarter sales of €8.8 Mn, down -16.3% at both actual and like-for-like exchange rates, despite a good performance from the service business of the Santéol and MSanté banners, respectively up +15.5% and +15.8% at actual exchange rates. In line with the first quarter of the year, the division is temporarily impacted by the ongoing operational integration within Almadia, the new entity, resulting from the recent merger of the Sédagyl and Médical Santé brands.

In a market environment that is still uncertain and economic activity marked by a decline in household consumption, Damartex is continuing its tactical steering to adjust its level of activity to the macroeconomic context and is continuing to focus its efforts on rolling out its new Dare. Act. Impact 2026 strategic plan.

The Group is sticking to its commitments and continuing to manage its business with commercial agility and caution, both in terms of expenditure and cash flow.

Damartex announces that it has entered into exclusive negotiations with the CTFI group for the sale of Afibel.

As part of its new strategic plan Dare. Act. Impact. 2026, Damartex announced in September 2023 its intention to put its Afibel business up for sale, in order to focus its efforts and investments on a limited number of brands.

The proposed transaction is subject to the usual consultation procedures with employee representative bodies. It is expected to be finalised in the first quarter of 2024

By making CSR one of the 4 pillars of its new strategic plan “Dare. Act. Impact. 2026”, the Group is determined to place its social responsibility at the heart of its business model.

The ambition is to make Damartex a profitable, sustainable Group that is useful to our society and our planet, and committed “On Seniors’ Side”.

Our challenge, as the Group CSR department, is to make our Change Our World programme a real compass to guide the decision-making of our teams and enable the Group to become a company recognised for its responsible performance.

Our ambition is not to change the world, but to make our contribution around our 4 commitments:

- to reduce our environmental impact

- to conduct our business responsibly

- to promote the company’s human capital

- to be a good corporate citizen

These commitments are being translated into concrete action at a time of upheaval in consumer behaviour, marked by a growing demand for transparency and more responsible products and services.

Despite difficult economic conditions, we have maintained our momentum this year, and our combined efforts have enabled us to implement high-impact projects for and with all our stakeholders.

It is therefore with sincerity, pride and, at the same time, a great deal of humility that we present, through this declaration of extra-financial performance, the results achieved this year in transforming our business model in depth towards a more responsible model and meeting the expectations of our stakeholders.

The year 2022-2023 has been a year of unique challenges and opportunities for Damartex in a shrinking economic context, particularly impacting the Silver Economy. It is with a sense of determination and resilience that I share with you an overview of our journey over the past year.

Aware of the headwinds the Group has had to face, this year’s financial results bear the mark of this difficult economic reality. However, despite these challenges, our teams have shown remarkable strength. The creativity, determination and commitment of our employees have been the pillars of our adaptability. We have been able to react quickly to market fluctuations in this complex environment by focusing on our operational priorities, such as proactive purchasing management, a savings plan to serve the business, dynamic inventory disposal and refinancing as part of a conciliation procedure.

Strongly committed to its ambition of becoming a European reference in the Silver Economy, the Group has structured the next stages of its development in its new 3-year strategic plan:

Dare. Act. Impact. 2026

The roadmap will be guided by four complementary themes:

- Delivering Financial Performance

- Innovative Brand Experience

- Change Our World

- Shared Leadership

After 2022/2023, a year dedicated to securing the Group’s future, Damartex will focus on implementing its strategic plan and continuing to manage its business rigorously so as to continue to cope with economic downturns.

We are convinced that our future success will depend on our ability to adapt to the profoundly changing economic environment. We remain committed to our employees, our customers/patients and our values, while looking for ways to innovate and invest in the future.

While the economic environment calls for caution, the Damartex Group has a number of important assets at its disposal, including the deployment of the new strategic plan “Dare. Act. Impact. 2026” strategic plan, and the quality and commitment of its employees. With its sights firmly set on the future, Damartex has all the resources it needs to become a leader in the Silver Economy.

Its raison d’être “On Seniors’ Side” remains at the heart of the Group’s actions.

A Year Dedicated to Securing the Group’s Future. Launch of the New Strategic Plan

BUSINESS

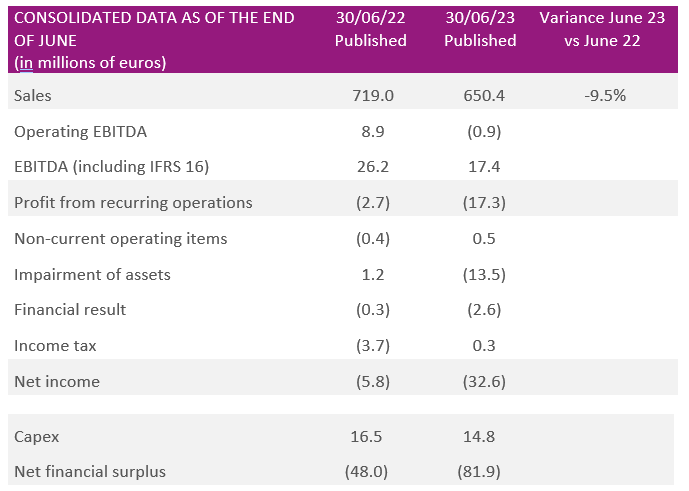

Damartex ended the 2022/23 financial year with sales of €650.4 Mn, down on the previous year (-9.5% at actual exchange rates, -9.0% at like-for-like exchange rates), still impacted by the unfavourable macroeconomic environment and the contraction in consumption observed in certain markets, particularly in Great Britain.

The Fashion Division’s sales came to €498.4 Mn, down -6.9% at actual exchange rates, despite a good performance from the store channel (+9.3%) and the Xandres banner (+22.1%).

The Home & Lifestyle division posted sales of €111 Mn, down -24.8% at actual exchange rates, still affected by the fall in demand for home items, particularly in the UK.

The Healthcare Division maintained its excellent growth momentum, posting a solid performance with sales of €41.1 Mn, a significant increase of +14.3% at actual exchange rates. During the financial year, the Group concentrated on integrating the acquisitions made in this division.

RESULTS

The Group’s operating EBITDA came to €-0.9 Mn, compared with €8.9 Mn last year, reflecting the fall in activity over the financial year.

With inflation still high and continuing to weigh on both demand and costs, the Group has implemented strict steering of its marketing costs, while maintaining commercial efficiency. More generally, Damartex has continued to manage its business very rigorously, by making impactful operational and strategic decisions. Against this backdrop, priority was given to securing the Group’s future.

Operating EBITDA came to €+3.9 Mn for the Fashion Division, reflecting the robustness of Damart and the dynamism of Xandres, and €-8.9 Mn for the Home & Lifestyle Division, as a direct consequence of the general fall in demand, while the Healthcare Division posted an operating EBITDA of €+4.1 Mn, thanks to a business less exposed to the economic conditions.

The Damartex Group ended the 2022/23 financial year with a net loss of €‑32.6 Mn.

FINANCIAL POSITION

The net financial position was €-81.9 Mn as of the end of June 2023 (against €‑48.0 Mn as of the end of June 2022). While the Group is vigilant in view of the current environment, it is nonetheless maintaining the investments necessary to achieve its ambitions, focusing mainly on digitalizing its activities.

The Working Capital Requirement stood at €31.6 Mn at end-June 2023, virtually unchanged from the previous year. This level reflects both the adjustment of purchases to demand and the net improvement/reduction in inventory levels, thanks to the Group’s proactive and efficient steering.

DIVIDEND

Considering the impact of the economic situation and the Group’s transformation momentum, the Management Board will not propose the distribution of a dividend at the Annual General Meeting scheduled for 16 November 2023.

OUTLOOK AND NEW STRATEGIC PLAN :

OUTLOOK AND NEW STRATEGIC PLAN :

As it is firmly committed to its ambition of becoming a European reference in the Silver Economy, the Group has structured the next stages of its development in its new 3-year strategic plan: DARE. ACT. IMPACT. 2026

This roadmap is built around four main complementary areas:

- Delivering Financial performance: Many initiatives will be put in place to optimize the operational profitability of each division. In this context, the Group has decided to put the Afibel business up for sale to concentrate its efforts and investments on a limited number of brands. In July 2023, the Sédagyl & Médical Santé brands were merged within the new Almadia entity to provide a single, comprehensive ageing-in- place offering. With its experience of steering in time of crisis, the Group has also launched a cost-cutting plan that will generate annual savings of €9 Mn.

- Innovative Brand Experience: Across its three divisions, the Group will focus its investment on developing the image and influence of its brands to create a resolutely innovative customer-patient experience.

- Change Our World: as it is aware of its social role, Damartex is stepping up its current momentum to achieve its ambition of reducing its carbon footprint by 25% by 2026.

- Shared Leadership: The Group is paving the way for a different kind of leadership, based on autonomy and shared responsibility.

After this year of transition/security, Damartex intends to continue its proactive and rigorous management of its activities to continue to face up to cyclical crises and to guarantee its long-term future.