Sales For the 2nd quarter of the 2025/2026 Financial Year

Maintained activity in the first half of the year, in a difficult consumer environment

Damartex closed the first half of the 2025/2026 financial year with sales of €279.3 million, almost stable compared to the previous year (-1.9% at actual exchange rates and -1.0% at like for like exchange rates). In a still volatile market environment, marked by consumption that is struggling to regain positive momentum, the Damartex group has posted stable sales and continues to show resilience, thanks to the implementation of an effective operational strategy for several quarters.

In line with the 1st quarter, the Group recorded revenue of €172.2 million in the 2nd quarter, down slightly by -2.0% at actual exchange rates (-0.9% at like for like exchange rates).

The “Fashion” division posted sales of €216.8 million for the half-year, almost stable at -0.8% at actual exchange rates (stable at like for like exchange rates). Q2 sales were in line with the same period last year (+0.1% at actual exchange rates and +1.0% at like for like exchange rates), despite the social unrest in France and Belgium; December was relatively favourable for textile sales. The Damart brand stabilizes its activity over the quarter (-0.2% at actual exchange rates, +0.8% at like for like exchange rates). Impacted by a particularly marked drop in consumption on the English market, Damart nevertheless saw an improvement in its sales in France, supported by the brand’s repositioning work implemented for several quarters. Xandres continued its multi-channel development and continued to post a solid performance with a further +5.4% increase in revenue at actual and like for like exchange rates.

The “Home & Lifestyle” division posted revenue of €47.8 million for the half-year, down -7.2% at actual exchange rates (-5.6% at like for like exchange rates). The second quarter was particularly adverse for the Coopers of Stortford and 3Pagen brands, with sales down -14.3% and -11.5% respectively at actual exchange rates. This trend can be explained by an overall decline in household consumption on the type of products offered by the division’s brands, and by an ongoing adjustment of offers by channel.

The “Healthcare” division generated revenue of €14.7 million, up 1.2% over the first half at constant actual exchange rates. In the second quarter, the division’s activity remained stable at €7.5 million. The Santéol brand, which benefited from a reinforcement of its teams, posted an increase in activity of +4.0% and Almadia, driven by its recent strategic refocusing, ended the period with growth of +3.5% at real and like for like exchange rates over the last quarter. With customer and patient satisfaction at the heart of its strategy, as evidenced by the further increase in its NPS (Net Promoter Score) to +58, Damartex is maintaining its commercial efforts and continuing to implement its Dare.Act.Impact 2026 plan, in a market environment that is still unstable. The Group continues to rigorously steer its various activities towards sustainable growth, based on promising long-term trends.

A resilient start to the financial year for the Group, which remains on track in a still mixed market environment

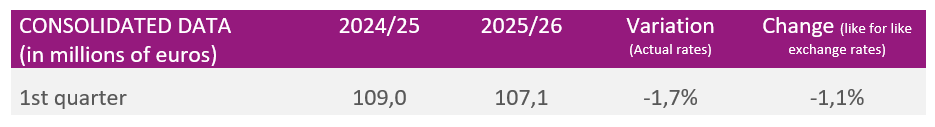

In the 1st quarter of the 2025/2026 financial year, the Damartex group posted sales of €107.1 Mn, almost stable at -1.7% at actual exchange rates compared to the 1st quarter of 2024/2025 (-1.1% at like for like exchanges rates). The Group maintains a rigorous and agile operational management in an unfavourable market marked by a certain wait-and-see attitude.

The “Fashion” division recorded revenue of €80.6 Mn in the 1st quarter, down slightly by -2.3% at actual exchange rates (-1.8% at like for like exchanges rates). Damart ended the first quarter down -3.2% at real exchange rates (-2.5% at like for like exchanges rates), impacted by a high basis of comparison and by consumption penalized by social movements in France. The brand nevertheless has a solid network, strengthened with the recent opening of its new store in Roubaix (at the brand’s headquarters), and continues to optimize the management of its sales channels.

Over the period, the Xandres brand continued its good momentum with sales up +3.2% at real and constant exchange rates, and focused on adapting its offer to each of its specific and buoyant markets.

“Home & Lifestyle” revenue was €19.3 Mn in the first quarter, stable compared to the same period last year (+1.2% at like for like exchanges rates). While Coopers of Stortford posted a decline of -8.2% due in particular to the ongoing adjustment of its marketing strategy, 3Pagen posted solid growth of +6.6% at real exchange rates.

Finally, the “Healthcare” division recorded revenue of €7.2 Mn over the quarter, almost stable at +0.9% at actual and constant exchange rates. The Santéol brand posted sustained activity, up +8.0% at actual exchange rates, driven in particular by the strengthening of the sales teams. Finally, Almadia, which is in the process of integrating the strategic evolution of its model, posted a -9.8% decline in revenue at real exchange rates. The brand is also temporarily penalised by the implementation of the regulatory reform of the full coverage of wheelchairs (scheduled for the end of the calendar year).

In the first quarter, Damartex continued the disciplined implementation of its Dare.Act.Impact 2026 plan, in a volatile macroeconomic and political environment. Supported by continuous innovation and with the satisfaction of its customers and patients as a priority, the Group remains focused on the smooth running of the activities of each of its divisions towards a return to sustainable growth.

Damartex continues its operational recovery and is committed to strengthening its commercial momentum.

PERFORMANCE BY pole

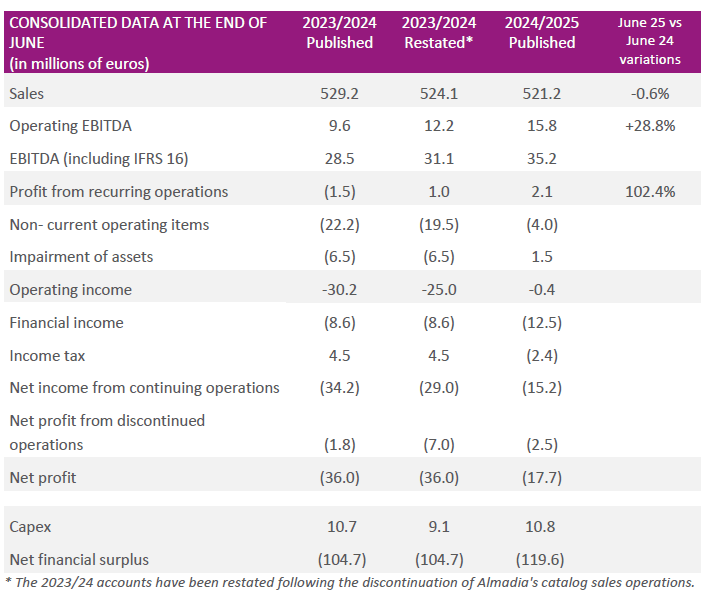

Damartex concluded the 2024/25 fiscal year with revenue of €521,2Mn, remaining nearly stable compared to the previous year (-0.6% at constant exchange rates, -1.1% at actual exchange rates). In a persistently challenging market environment, the Group has stabilized its revenue after three years of decline and confirmed the momentum of profitability recovery initiated last year.

The “Fashion” division’s revenue for the 2024/2025 fiscal year stands at

€389.4 Mn, reflecting a slight decline of -1.7% at actual exchange rates (-2.2% at constant exchange rates) amid a challenging environment. While the Damart brand experienced a modest decrease in revenue (-2.4% at actual exchange rates), the Xandres label recorded an annual revenue increase of +5.7% at actual exchange rates. EBITDA of Fashion division reached €13,3Mn, marking a significant rise that underscores Damart’s solid fundamentals, the strategic positioning of Xandres, and the Group’s ongoing efforts to enhance the profitability of the division’s brands.

The “Home & Lifestyle” division reported annual revenue of €102.7Mn, reflecting a real exchange rate growth of +3.5%. Amid significant sectoral changes, investments in digital channels and product range renewal facilitated the acquisition of new customers. However, the Group has yet to realize the anticipated benefits for this division, resulting in a slight decline in EBITDA compared to the previous year, closing at €-1.7Mn.

The “Healthcare” division reports annual revenue of €29.1Mn, representing a +1.6% increase at constant and real exchange rates, driven by the growth momentum of Santéol and the encouraging results from Almadia following the strategic repositioning of its service activities initiated in the previous fiscal year. The Healthcare division’s EBITDA stands at €4.2Mn, showing a slight decline compared to the previous year.

FINANCIAL RESULTS

Damartex’s operational EBITDA shows a significant improvement, reaching €15.8Mn compared to €12.2Mn last year, representing an increase of +28.8%. This reflects stringent and agile cost management across all divisions to achieve sustainable growth. The Group closes the 2024/25 fiscal year with a net result of €-17.7Mn, demonstrating considerable improvement but still reflecting the impact of financing costs on the fiscal year.

FINANCIAL POSITION

The net financial position stands at €-119,6Mn as of the end of June 2025 (compared to €-104.7Mn as of the end of June 2024), reflecting the debt burden and ongoing investments necessary for the Group’s transformation.

The working capital requirement is €23.1Mn as of the end of June 2025, remaining stable compared to the previous fiscal year. This outcome confirms the sound management executed by the Group’s teams.

DIVIDEND

The Executive Board will not propose the distribution of dividends at the General Meeting scheduled for November 20, 2025.

PERSPECTIVES

Fully committed to its ambition of becoming a European benchmark in the Silver Economy, Damartex is advancing the second phase of its strategic plan DARE.ACT.IMPACT 2026, structured around four key complementary pillars:

• Delivering Financial Performance: The Group is beginning to realize the benefits of the restructuring undertaken and continues its implementation, consistently focused on enhancing the operational profitability of its divisions.

• Innovative Brand Experience: The teams are advancing brand development and omnichannel innovation to refine the customer-patient experience.

• Change Our World: Aware of its societal responsibility, Damartex is actively pursuing the reduction of its carbon footprint. • Shared Leadership: Initiated in 2023/2024, the implementation of an innovative leadership approach focused on autonomy and shared responsibility is progressing, aiming to enhance adaptability and ensure transparent communication.

“Damartex continues to shape its legacy: that of a Group that meets challenges head-on and transforms obstacles into opportunities. Thanks to the dedication and professionalism of our teams, we are strengthening our core foundations while paving the way for new prospects. Our ambition is clear: to combine performance with a positive impact, serving the clients and patients who place their trust in us,” states Nicolas Marchand, CEO of the Damartex Group.

Damartex stabilizes its business and continues its transformation efforts towards sustainable growth

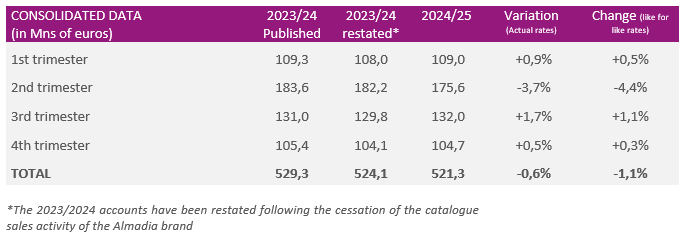

Damartex closed the 2024/2025 financial year with revenue of €521.3 Mn, almost stable compared to the previous year (-0.6% at actual exchange rates, -1.1% at like for like exchange rates). Despite a still adverse market environment, the Group’s three divisions confirm that their business is stable. In the second half of the year, the Group posted revenue of €236.7 Mn, up +1.2% at actual exchange rates (+0.8% at like for like exchange rates).

The fourth quarter was particularly buoyant for online sales, which posted positive growth momentum in each of the Group’s divisions. Damartex thus closed its last quarter with revenue of €104.7 Mn, up +0.5% at actual exchange rates (+0.3% at like for like exchange rates).

The “Fashion” division posted revenue of €389.4 Mn in the 2024/2025 financial year, down slightly by -1.7% at actual exchange rates (-2.2% at like for like exchange rates). The Damart brand was able to offer new ranges of innovative products to its customers, but remains penalised by a still deteriorating French market and closed the year with a slight decline in sales of -2.4% at real exchange rates. After a decline in the first six months due to the withdrawal of sales of underwear from the Thermolactyl range, the second half of the year recorded growth of +0.5% at real exchange rates. The Xandres brand continued its European development and posted solid performance, with sales up +5.7% at real exchange rates for the full year.

The “Home & Lifestyle” division benefited from positive demand, and posted revenue of €102.7 Mn, up +3.5% at actual exchange rates over the year (+2.6% at like for like exchange rates). The 3 brands in the division posted growth in their turnover over the year.

Finally, “Healthcare” revenue amounted to €29.1 Mn, up +1.6% at actual exchange rates. Santéol confirmed its trend of previous years and posted a +4.4% increase in sales at actual exchange rates over the year. Almadia is reaping the first benefits of the strategic repositioning of its services activities, with revenue almost stable over the year and growth of +2.5% over the last six months.

In a still deteriorating economic and commercial context, Damartex is maintaining the rigorous management of each of its activities, its costs and the proactive management of its cash flow.

In addition, the Group has entered into an agreement with its banking partners to extend its financing lines, the main features of which are: optimization of the lines with a reduction of €12.3 Mn, maintenance of financial conditions and a maturity date of August 3, 2027.

The Group is currently reviewing the ambitions of its Dare.Act.Impact 2026 strategic plan in order to take into account market trends and ensure sustainable growth in profitability.

At its annual results presentation on September 18, 2025, the Group will share the progress of the implementation and the next steps of its strategic plan

Damartex confirms its trajectory despite a demanding context

Damartex closes the third quarter of the 2024/2025 financial year with revenue of €132.0 Mn, up year-on-year (+1.7% at actual exchange rates and +1.1% at like for like exchange rates). This performance confirms the resilience of the brand portfolio and the Group’s agility in the face of a turbulent macroeconomic context that is impacting consumer behavior.

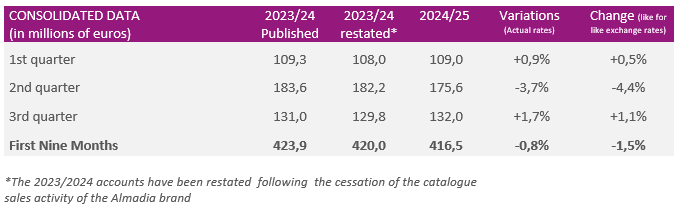

Over the first nine months of the year, Damartex posted sales of €416.5 Mn, almost stable compared to the same period last year (-0.8% at actual exchange rates and -1.5% at like for like exchange rates ).

The Fashion division recorded revenue of €317.1 Mn in the first nine months, down -2.1% at actual exchange rates (-2.7% at like for like exchange rates).

In the third quarter, sales in this division were up +1.3% at real exchange rates (+0.8% at like for like exchange rates), driven by solid commercial momentum in February and March. Despite a downturn in January marked by a controlled withdrawal from the sales period due to the good management of its stocks, Damart closed with a positive quarter, thanks to a clientele that was ready for its new collections. While the Xandres brand posted a decline of -3.8% over the period due to better stock quality during the sales period and a new delivery schedule for multi-brand customers, the brand nevertheless maintained a sustained level of activity over the first nine months, up +3.6% compared to the same period of the previous year.

The Home & Lifestyle division confirmed its return to growth, benefiting from its operational and strategic evolution, and closed the first nine months of the year with revenue of €77.6 Mn, up +3.7% at actual exchange rates (+2.6% at like for like exchange rates). Over the last quarter, it stands at €26.1 Mn, up +3.0% at actual exchange rates (+2.1% at like for like exchange rates).

Finally, the Healthcare division posted revenue of €21.8 Mn in the first nine months of the year, an increase of +2.8% at actual and like for like exchange rates. In the third quarter, the activity of the division dedicated to healthcare grew by +2.6% at actual and constant exchange rates and ended the period at €7.3 Mn, still benefiting from the dynamism of Santéol. This performance testifies to the efficiency of our teams and the relevance of the strategic retargeting of Almadia’s service activities.

While the tense economic environment is impacting consumption, Damartex is nevertheless starting to reap the benefits of its transformation strategy, and intends to maintain its strict discipline in inventory management and cost management. The Group is therefore confidently continuing to roll out its Dare.Act.Impact 2026 strategic plan, to maintain this sustainable trajectory over the coming quarters.

Damartex takes advantage of the first positive effects of its strategic plan and improves operating profitability

ACTIVITY & PERFORMANCE BY DIVISION

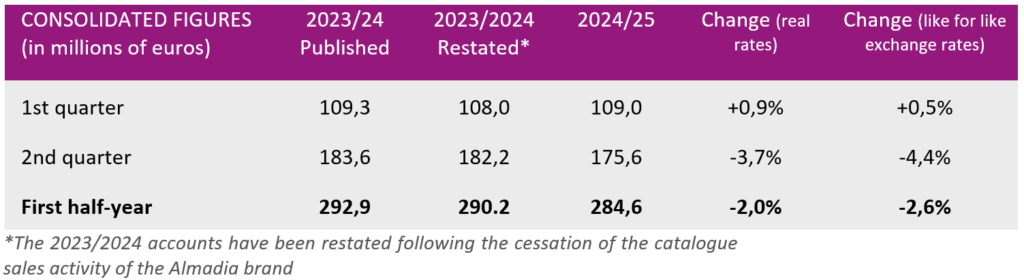

Damartex closed the first half of the 2024/2025 financial year with sales of €284.6 Mn, slightly down compared to the previous year (-2.0% at actual exchange rates and -2.6% at like for like exchange rates).

The “Fashion” division’s sales amounted to €218.6 Mn for the half-year, down -3.6% at actual exchange rates (-4.2% at like for like exchange rates). While the Xandres brand continues to perform well in recent quarters (+8.8% compared to the same period of the previous year), Damart has observed a decline in its business, impacted by lower-than-expected seasonal demand for underwear from the Thermolactyl range.

The ” Home & Lifestyle ” division returned to growth, driven by the operational and strategic choices made by the Group, and closed the half-year with sales of €51.5 Mn, up +4.1% at actual exchange rates (+2.9% at like for like exchange rates). This trend is supported by a strong performance in digital sales.

Finally, the ” Healthcare ” division posted sales of €14.5 Mn, up +3.0% over the first half at constant real exchange rates. Faced with the closure of Almadia’s mail-order channel, the teams implemented a targeted reorganization over the period in order to optimize the transition and ensure the continuity of operations.

FINANCIAL RESULTS

The Group’s operating EBITDA was €12.6 Mn, compared with €6.6 Mn last year. This significant improvement towards better profitability is the result of continuous work on margins and the optimisation of marketing costs and fixed costs.

Operating EBITDA amounted to €12.4 Mn for the “Fashion” division, with a clear increase in the profitability of the Damart brand and a historic first half in terms of profitability for Xandres. The “Home & Lifestyle” division closed the half-year with an EBITDA of -€1.9 Mn, mainly penalized by supply tensions, which caused delivery delays and therefore pressure on distribution costs. The “Healthcare” division continued its development and posted an EBITDA of €2.1 Mn.

Damartex closed this half-year with a net income from continuing operations of -€2.6 Mn compared to -€10.9 Mn for the 1st half of 2023/2024.

FINANCIAL POSITION

The net financial position stood at -€101.8 Mn at the end of December 2024 (compared to -€104.7 Mn at the end of June 2024), illustrating the actions taken on profitability, proactive inventory management and investments made by the Group in the first half of the year.

Working capital requirements amounted to €18.6 Mn at the end of December 2024, compared to €33.3 Mn last year.

PERSPECTIVES

Now led by Nicolas Marchand, CEO since February 2025, Damartex intends to continue and strengthen this positive dynamic, with the primary objectives of returning to profitability and customer satisfaction.

Benefiting from the concrete effects of the first phase of its DARE.ACT.IMPACT 2026, the Group confirms its relevance and is committed to effectively deploying the second chapter, focused on the sustainable growth of its activities.

Resilience of the business over the first half and continued implementation of the Dare. Act. Impact 2026 strategic plan

Damartex closed the first half of the 2024/2025 financial year with revenue of €284.6 Mn, slightly down compared to the previous year (-2.0% at actual exchange rates and -2.6% at like for like exchange rates).

Despite the impact of the economic situation over the period, the Group’s business proved resilience, supported by effective operational management and a promising dynamic in digital and physical sales.

However, sales for the second quarter amounted to €175.6 Mn, down -3.7% at actual exchange rates (-4.4% at like for like exchange rates). This quarter, penalised by inclement weather for the consumption of thermal textiles, masks the good performance of the Home & Lifestyle brands.

Despite a positive first quarter, the “Fashion” division posted revenue of

€218.6 Mn for the half-year, down -3.6% at actual exchange rates (-4.2% at like for like exchange rates). Sales in the second quarter were down -6.5% at actual exchange rates (-7.1% at like for like exchange rates). The Damart brand closed the quarter with revenue down -7.2% at actual exchange rates (-7.9% at like for like exchange rates) compared to the same period last year. This change is mainly due to a decline in consumption of underwear from the Thermolactyl range.

Xandres, an “affordable luxury” brand, is continuing its multi-channel conquest with strong revenue growth in the second quarter (+10.6% at real and like for like exchange rates). The “Home & Lifestyle” division returned to growth, driven by the operational and strategic choices made by the Group, and ended the first half with sales of €51.5 Mn, up +4.1% at actual exchange rates (+2.9% at like for like exchange rates). The second quarter was particularly dynamic for the Coopers of Stortford and 3Pagen brands with overall sales growth of +13.9% and +8.3% respectively at actual exchange rates. This trend is mainly due to a strong performance in digital sales.

The “Healthcare” division posted sales of €14.5 Mn, up +3.0% over the first half at real and like for like exchange rates. In the second quarter, the division’s activity remained stable at €7.4 Mn, driven in particular by the Santéol brand, up +5.0%. Almadia, whose catalogue sales activity has now been discontinued, closed the period with a structural decline in sales of -6.2%.

In a still unstable environment, the Group confirms its commercial resilience, marked by the successful completion of the management work carried out by each of its divisions.

Damartex is methodically continuing to roll out the second chapter of its Dare. Act. Impact 2026 strategic plan, dedicated to the sustainable development of its activities, with agility, prudence and rigorous execution as its watchwords.

The Group announces the forthcoming arrival of Nicolas Marchand as Chief Executive Officier

After 16 years at the helm of Damartex, Patrick Seghin has announced his intention to leave the Group to take up non-executive positions. He will remain with Damartex until 31 March 2025 to ensure an effective transition to his successor, Nicolas Marchand, who will join the Group on 1 January 2025 and will take up his post as Chairman of the Executive Board on 17 February 2025.

With solid experience in steering and managing companies in a variety of sectors, Nicolas Marchand has held a number of key positions at McKinsey, BNP Paribas Fortis, VOO, a Belgian internet and telephony operator, and more recently Trafic, where he was Managing Director. Nicolas helped to define the new strategic roadmap for Trafic, a Belgian non-food retailer also present in France and Luxembourg, and supported the company’s transformation and growth.

‘I am delighted that Nicolas Marchand has joined Damartex as CEO. His varied experience and ability to grasp the challenges of multiple sectors and adapt to the different markets in which our Group operates are undeniable assets. I would also like to extend my warmest thanks to Patrick Seghin for his unwavering commitment to Damartex, for his leadership and for his contribution to the company’s development and transformation since 2008,’ says Jean Guillaume Despature, Chairman of the Supervisory Board.

‘I’m very honoured to have been given this opportunity to contribute to the development of the Damartex group. I’m joining a meaningful company with a rich history, strong values and solid fundamentals. I’m looking forward to meeting the teams and writing the next pages of the adventure with them’, says Nicolas Marchand, future CEO of Damartex Group.

‘After more than 16 years at the helm of the Damartex Group, I would like to express my deepest gratitude to all my colleagues, to the Supervisory Board and to our historic shareholder, who have never ceased to place their trust in me. I’m proud to have been able to contribute to the development of a bold, unique French company that is now recognised beyond our borders,’ adds Patrick Seghin, Chairman of the Management Board of the Damartex Group.

By integrating CSR at the heart of its “Dare Act Impact 2026” strategy, the Damartex Group reaffirms its ambition to guarantee its profitability and sustainability, while strengthening its social, environmental and societal utility through its “On Seniors’ Side” commitment. The Extra-Financial Performance Statement for the 2023-2024 financial year illustrates the concrete actions taken this year to achieve these objectives.

Our CSR strategy, Change Our World, is based on concrete ESG criteria. This policy is a compass guiding our strategic decisions, with a clear ambition, to actively contribute to the ecological and social transition around our four main commitments:

- Reducing our environmental impact

- Promoting human capital

- Ethical business conduct

- To be a committed corporate citizen, particularly in favour of seniors.

This year, despite an unstable context, we have stepped up our action in several areas. We measured our CO2eq emissions for the third time and continued our efforts to reduce our carbon footprint by 25% by 2026. The design of more responsible products is progressing, with 33% of our collections now meeting sustainable criteria. We have also stepped up our ethics efforts, towards our ambition of 80% of products brought to market from audited factories by 2026. At the same time, we continued to promote the well-being and development of our employees. Finally, our On Seniors’ Side Foundation continues its actions in favor of seniors, by supporting solidarity projects and strengthening its societal commitment.

These results, achieved with and for our stakeholders, demonstrate our collective commitment to fundamentally transform our business model. It is with sincerity, pride and humility that we share these advances, while recognizing that the road to a sustainable future is still long.