Results for the First Half of the 2020-2021 Financial Year

Continued Transformation and Development

ACTIVITY

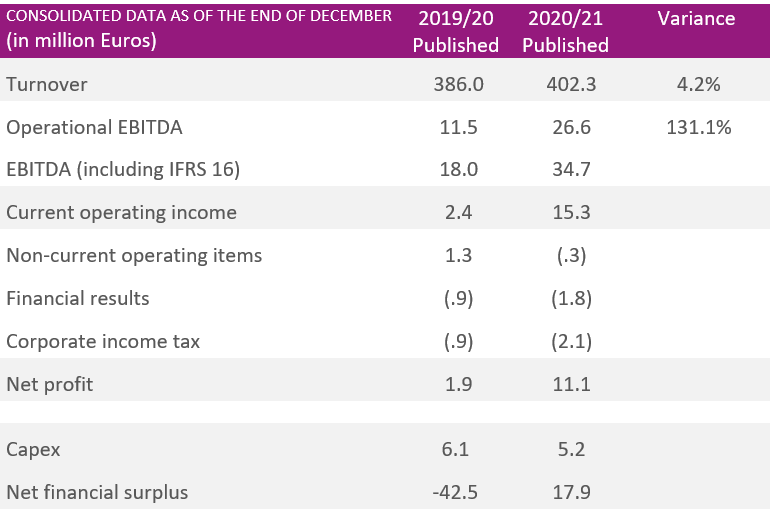

Sales for the first half of the year came to €402.3 million, up +4.2% at actual rates compared with the same period last year (+4.7% at like for like exchange rate).

Sales for the “Fashion” business came to €297.8 million, a slight increase of +.6% at actual rates. (+1% at a constant exchange rate). After a decline in activity in the first quarter of 2020-2021, due to the impact of the health crisis and restrictive measures, the division recorded a sharp rebound in the second quarter (+2.6% at actual rates). This momentum observed in the first half of the year, was driven in particular by the Damart brand (+1.5% at actual rates) mainly due to the excellent performance of mail order. The “Home & Lifestyle” business continued to grow at a dynamic rate of +12.2% at actual rates (+13.0% at like for like exchange rate) for €89.1 Mn of turnover. The division also returned to excellent momentum in the second quarter (+14.4% at actual rates) driven by the favourable reception given to the renewed Coopers of Stortford range, as well as strong growth in the 3Pagen and Vitrine Magique brands.

Finally, the recently created “Healthcare” division, dedicated to healthcare activities, confirmed its objectives with an increase of +47.3% at actual rates (+48.1% at like for like exchange rate) with a turnover of €15.4 million. This growth is supported by the two brands that make up the division: Santéol (integrated in 2020) and Sedagyl.

RESULTS

The operating EBITDA closed with a significant increase to €26.6 Mn (compared with €11.5 million in the previous financial year). This performance is explained by the rebound in activity recorded mainly in the second quarter of 2020, combined with a careful policy of cost control, particularly in marketing, in order to prudently address a deteriorated market environment.

The current operating income (so-called ROC) therefore shows strong growth at €15.3 million (compared with €2.4 million in the previous financial year). This performance applies to all the “Fashion”, “Home & Lifestyle” and “Healthcare” divisions, with a ROC of €8.5 Mn, €5.4 Mn and €1.4 Mn respectively. Net earnings stand at €11.1 Mn (compared with €1.9 Mn for the previous financial year).

Damartex thus returned to a good level of profitability in the first half of the year, confirming the trend initiated in the 2019 financial year.

FINANCIAL POSITION

The net financial position stands at €+17.9 Mn (against €-42.5 million in the previous financial year). This increase is the result of the growth in activity and is mainly based on two levers:

- the taking into account of the exceptional capital increase of €33.9 million; and

- the excellent management of working capital requirements (€-9.9 Mn compared to €31.8 Mn in 2019) despite an extremely volatile environment due to the health crisis. This performance is the direct consequence of the efforts undertaken in axis 4 of the transformation plan (priority to agility).

The Group’s financial strength enables it to accelerate its transformation plan and pursue an opportunistic external growth policy in line with its development ambitions in the Silver Economy market.

OUTLOOK

This commercial performance, despite the health crisis context, combined with a reinforced financial soundness, are solid assets to address the future. Damartex is thus proactively pursuing the deployment of its TTA 2.0 transformation plan, particularly on the digitalization aspects, enabling it to address the challenges of the Silver Economy market. However, the Group remains cautious in view of the remaining uncertainties related to the novel coronavirus epidemic