Acquisition of Icelus Médical

Strengthening of Santéol in the Paris Region

The Damartex group announces the acquisition of 100% of the shares of the ADS company by Santéol holding. This operation, like the previous ones, is part of the implementation of the Group’s transformation plan “Transform to Accelerate – TTA 2.0”.

The ADS company, a home healthcare provider (so-called PSAD) specializing in respiratory assistance, is based in Villeparisis in Seine-et- Marne (France).

Founded in 2014 by David Sdez, it has achieved a turnover of over €3 Mn in 2021 thanks to the trust of over 5,500 patients who recognize its quality of service.

This merger will enable Santéol to accelerate its development. Combined with the existing presence in the west of Paris, Santéol will be in a position to best serve all patients in the Paris region.

With his expertise, David Sdez will provide commercial support for the integration of ADS into the Santéol group over the next twelve months.

In line with its ambition to become the European leader in the Silver economy, the Damartex group expresses through this acquisition its desire to continue the development of its Healthcare division.

The integration of ADS strengthens Santéol’s position as a leader in respiratory Home Healthcare Service segment, with more than 22,000 patients cared for and a geographical coverage that allows for more local service.

ADS will be integrated into the Damartex Group’s accounts as of 1 July 2022.

Progress of the TTA 2.0 Transformation Plan Slowdown in Business in an Inflationary Context

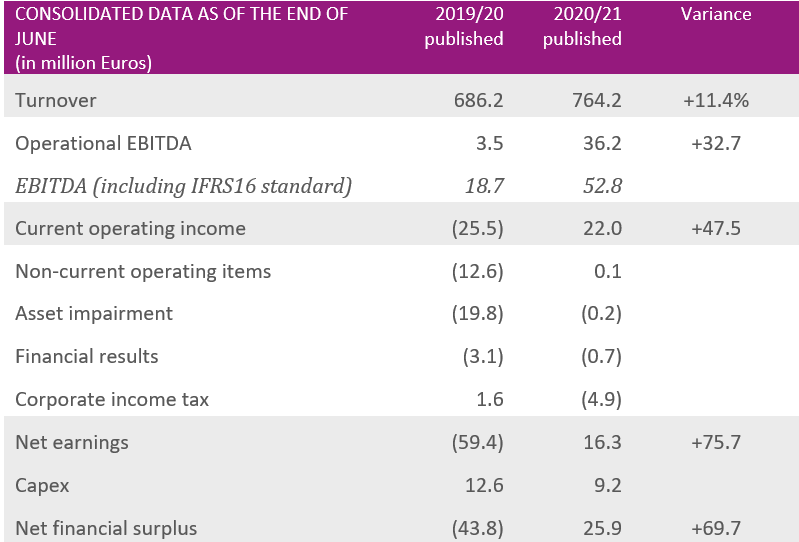

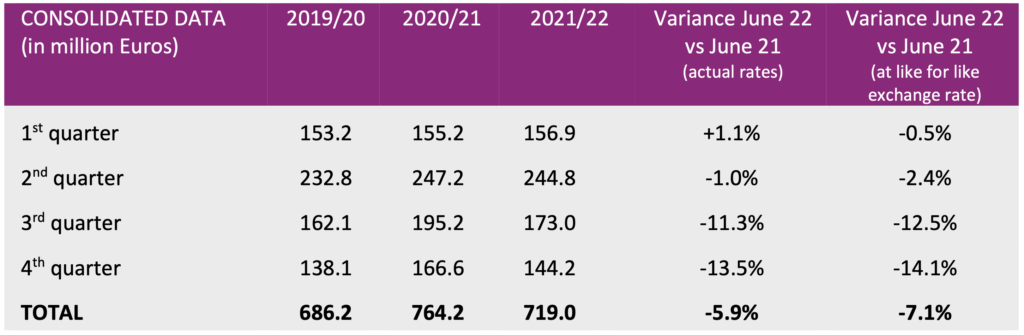

Damartex closed the 2021/2022 fiscal year with sales of €719.0 million, down -5.9% at actual rates compared with the previous year (-7.1% at like for like exchange rates), impacted by a difficult economic context. After a stable first half compared with the previous year, the Group posted revenues of

€317.2 Mn in the second half of the year, suffering from a slowdown in sales of -12.3% at actual rates (-13.2% at like for like exchange rates) against the same period last year.

Damartex continues to strengthen its customer base, which was enhanced by 1.4 million new customers in the first half of the year, by adding 0.8 million new customers in the second half of the year, including 0.3 million in the fourth quarter.

In the fourth quarter, business fell significantly, particularly affecting the “Fashion” and “Home & Lifestyle” divisions. Despite a good performance in “Healthcare”, driven in particular by the dynamism of recent acquisitions, the quarter closed at €144.2 Mn, down -13.5% (-14.1% at like for like exchange rates).

Sales for the “Fashion” division amounted to € 535.5 Mn over the 2021/2022 financial year, down -3.5% at actual exchange rates. This division has seen strong growth in stores (+23.8% compared with last year). The revenue level observed for this sales channel is also up +19% compared with 2019/2020.

Damart remained robust in the face of the economic situation, but suffered a slight decline of -2.4% at actual rates over a year marked by the slowdown in the traditional “mail order” channel, while Afibel recorded a decline of -8.9% at actual rates. Benefiting from its positioning in the affordable luxury segment, Xandres posted record performances in Belgium and the Netherlands, representing an increase of +20.4% at actual exchange rates.

The “Home & Lifestyle” division was particularly affected by the deterioration in the macroeconomic environment, and posted revenues of €147.6 million, down -16.9% at actual exchange rates over the year (down -18.6% at like for like exchange rates). The sales of the three banners suffered from a very unfavourable base effect on e-commerce, which had benefited from the health crisis.

Lastly, sales for the “Healthcare” division, which includes the Sedagyl, Medical Santé, Santéol and MSanté banners, amounted to €35.9 million, up significantly by +14.3% at actual exchange rates and +13.4% at like for like exchange rates. This good momentum in the Healthcare division continues to be reinforced by recent acquisitions, perfectly in line with the TTA 2.0 transformation plan.

Santéol, a home healthcare provider specializing in respiratory assistance, continued to grow at +18.4% at actual rates in FY 2021/22, while Sédagyl, an marketplace for home care, recorded a decline of -9.2% at actual rates, negatively impacted by the Covid base effect.

Despite a deteriorated macroeconomic and geopolitical environment, Damartex is continuing to deploy its strategic plan: Transform to Accelerate 2.0 to support its development while coping with persistent tensions on supplies. The Group is exercising caution by remaining extremely agile with regard to the rapid evolution of the economic environment, and anticipates, as mentioned at the time of the publication of the third quarter revenues, a negative impact on the annual results of the 2021/2022 fiscal year.

Further development in the “Healthcare” sector and restructuring of the homecare (MAD) activity

As part of its ‘Transform To Accelerate – TTA 2.0’ transformation plan, the Damartex group announced its acquisition of 100% of the shares in the Médical Santé group, thereby reinforcing its position as a European leader in the Silver Economy.

Created in 1997 by Charles-Henri Bastien and based in Mons-en-Barœul (59), the Médical Santé group boasts a staff of 85 employees and offers homecare health products (MAD) and services (PSAD). Médical Santé generated a turnover of € 10 M in 2021 thanks to the trust it has built with more than 800 chemists as well as hospitals and associations, and also through the development of e-commerce.

Following this acquisition, Damartex plans on merging Médical Santé with Sédagyl, the Group’s platform for comfortable living solutions. It was created in 1995 and specialises in homecare for seniors. Their complementary business models will further the Group’s goal of offering the best omnichannel products and services offer on the market, while establishing a relationship with its patients and customers based on respect and trust.

Charles-Henri Bastien will support the integration of Médical Santé through the summer of 2022. Christian Marie, who has extensive experience in this sector, will join the Damartex group as the Managing Director of the new homecare department (with Médical Santé and Sédagyl) and will be in charge of developing this activity.

“I am delighted and extremely proud of Médical Santé’s integration within the Damartex group, which shares our values. The synergies between our brands will make it possible to continue developing a comprehensive and innovative offer that will set us apart on the homecare market,” said Charles-Henri Bastien, the General Director and Founder of Médical Santé.“We look forward to bringing on board the Médical Santé teams. The merger with Sédagyl will lead to the emergence of a French player offering an omnichannel solution to assist the elderly and enable them to stay at home as long as possible, which is what the vast majority of them desire,” added Patrick Seghin, Chair of the Damartex executive management board.

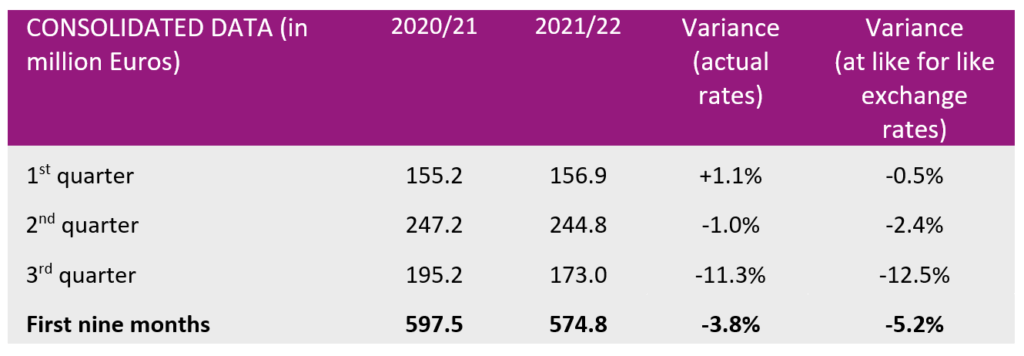

Continuation of the Group’s Transformation Plan Despite an Uncertain and Inflationary Environment

Damartex closed the third quarter with sales of € 173.0 Mn, down -11.3% at actual exchange rates (down -12.5% at like for like exchange rates) compared with the third quarter of the previous financial year. The Group’s business is suffering from record inflation, particularly in the UK and Germany, leading to a contraction in consumption. The base effect is also unfavourable: the third quarter of 2020/21 saw a strong recovery in demand, with, as a reminder, a +20.8% growth in turnover compared with €162.1 Mn in the 3rd quarter of 2019/20.

Building on a customer base that had been built up with 1.4 million new customers in the first half of the year, Damartex added 525,000 new customers in the third quarter. This is a slowdown compared to the third quarter of 2020/21 but an increase of 25,000 new customers compared to the same quarter pre-covid.

For the first nine months of the financial year, Damartex’s sales were down by -3.8% at actual exchange rates (-5.2% at like for like exchange rates) to € 574.8 Mn.

Sales for the “Fashion” division came to €432.7 million for the first nine months, stable against the last financial year (-0.8% at actual exchange rates, -1.9% at like for like exchange rates). In the third quarter, sales shrunk by -7.5% at actual rates (-8.6% at like for like exchange rates).

Over the quarter, the Xandres brand performed well, with very strong growth of +44.6% at actual and like for like exchange rates, driven in particular by the dynamic Belgian market and the brand’s positioning. Arbitrage on consumption impacted Damart and Afibel, respectively down -8.7% at actual rates (-10.0% at like for like exchange rates) and -12.6% at actual and constant rates over the quarter.

Sales for the “Home & Lifestyle” division came to € 117.2 Mn, down by -15.0% at actual exchange rates (-17.0% at like for like exchange rates) over the first nine months. Sales for the third quarter amounted to € 37.0 Mn, (-24.2% at actual exchange rates, -25.6% at like for like exchange rates).

This decline is explained in particular by the impact of inflation in the United Kingdom, which is at its highest level since the 1990s, on the Coopers of Stortford brand, and the strong base effect compared with the previous financial year. The company recorded a drop of -34.4% at actual rates over the quarter (-37.3% at like for like exchange rates), particularly marked on a very strong decline in e-commerce in the sector.

Finally, the “Healthcare” division, which includes the Sedagyl, Santéol and MSanté brands, reported sales of €24.9m, confirming the good momentum of the business with growth of +5.5% at actual exchange rates over the first nine months (+4.5% at like for like exchange rates). For the quarter, the business stabilized at +0.3% at actual exchange rates (-0.5% at like for like exchange rates) with sales of € 8.2 Mn.

Outlook

The deteriorated economic environment is prompting the Damartex Group to accelerate its development and pursue the transformation actions that are part of its Transform to Accelerate 2.0 strategic plan.

The Group is not directly exposed to the Ukrainian conflict. However, in this geopolitical context, which is likely to affect the global economy and accentuate inflation and supply tensions over the coming months, the Group anticipates a negative impact on its results and remains cautious as to the evolution of the situation.

The Damartex group announces the acquisition of 100% of the shares of the company JP Consult by the company Santéol Holding. This operation, like that of Perf R in Île de France recently, is part of the group’s transformation plan: “Transform To Accelerate – TTA 2.0”.

JP Consult is a home health care provider (PSAD) specialising in respiratory assistance and based in Mouroux, Ile de France.

JP Consult was founded in 2012 by Michel Crépin and has achieved a turnover of nearly €1.2 million in 2021 thanks to the trust of more than 2,000 patients who recognise the quality of service and the responsiveness of the teams in place.

This merger will enable Santéol to develop its activity in the Centre-East of France due to the presence of JP Consult in 5 departments in this region. Through the growing demand on the market, this operation is in line with the group’s ambition to become the European leader in the Silver economy, and illustrates Damartex’s desire to strengthen its Healthcare division.

With his expertise in this sector, Michel Crépin will take over the management of the Santéol Bourgogne Franche-Comté agency to accelerate this development.

With the integration of JP Consult, Santéol continues its geographical expansion and now covers most of France. The company is reinforcing its position as leader with nearly 17,000 patients cared for and a network of agencies allowing for ever greater proximity.

The integration of JP Consult in the accounts of the Damartex Group will take place on 1 January 2022.

As part of its “Transform To Accelerate – TTA 2.0” transformation plan, the Damartex group announces the acquisition of 100% of the shares of the company Perf R by the company Santéol île de France.

The company Perf R, a home health care provider specialising in respiratory assistance, is based in Palaiseau in Ile-de-France.

Perf R was founded in 2011 by Kader Abdellaoui. The entity has achieved a turnover of nearly €0.8M in 2021 thanks to the trust of 1,100 patients who recognise the quality of service and the responsiveness of the teams in place.

This merger will strengthen Santéol’s presence in the Paris region. The Croissy-sur-Seine branch will host the Perf R teams.

Given his experience in the profession, Kader Abdellaoui will take over the commercial management of Santéol in France. The integration of Perf R in the accounts of the Damartex group will take place as of 1 January 2022.

Damartex expands its geographical coverage with the launch of Xandres, its affordable luxury brand on the German market.

Xandres is a leading Belgian fashion brand, synonymous with quality and attention to detail, and is already present in Belgium, Luxembourg and the Netherlands.

The Xandres collections are designed for women who appreciate classic and timeless fashion, in line with current trends. Since the 1970s, the brand has been dressing all women from size 34 to 56 with naturally chic items that fit perfectly.

On 16 February 2022, Xandres held a press conference at the Soho House in Berlin to introduce itself to German fashion journalists and to launch its communication campaign.

Xandres is proud of its partnership with Veronica Ferres, a renowned actress in Germany with 145,000 subscribers, and her 20 year old daughter Lilly Krug, also an actress and social network personality.

The collections will be offered through 3 distribution channels: the Xandres.de website, the market places: Zalando and Van Graaf, and the presence in multi-brand shops.

The Damartex group is pleased to support the brand in its internationalisation and to continue the development strategy of its Fashion division.

www.xandres.de – www.xandres.be

Ongoing development of the Healthcare division

As part of its transformation plan “Transform To Accelerate – TTA 2.0”, Damartex

group announces the acquisition of 100% of the shares of Optimum Médical by

the holding company MSanté. MSanté was acquired by Damartex in July 2021

to expand its Healthcare division in the infusion and nutrition sectors.

Optimum Médical, based in the South of France, is a home healthcare service

provider (so-called PSAD), also specialised in infusion and nutrition.

This transaction should enable Optimum Médical to grow strongly, in particular

by benefiting from MSanté’s support in treatments for chronic diseases.

In addition, MSanté and the Damartex group will provide all the levers in terms

of know-how and resources to accelerate Optimum Médical’s development.

This operation is fully in line with the Group’s transformation plan.Damartex is

extending its national geographical coverage for home health services and

strengthening its Healthcare division, which is made up of :

- Sédagyl, homecare products distributor, present in France and in England.

- Santéol, a home healthcare provider specialised in respiratory assistance,

present in France with a network of 6 agencies. - MSanté, a home healthcare provider specialised in infusion and nutrition,

present in France, in the West with 3 agencies, and now in the South with the

integration of Optimum Médical.

Optimum Médical, founded in 2017 by Sonia Zhar and based in Montpellier,

expects a turnover of nearly €1.5m in 2021. The company already benefits from

the trust of more than 800 patients who recognise the quality of service and the

responsiveness of the teams in place.

Optimum Médical will be integrated into the Damartex Group’s accounts from

1 October 2021.