Turnover of the First Nine Months of the 2021/2022 Financial Year

Continuation of the Group’s Transformation Plan Despite an Uncertain and Inflationary Environment

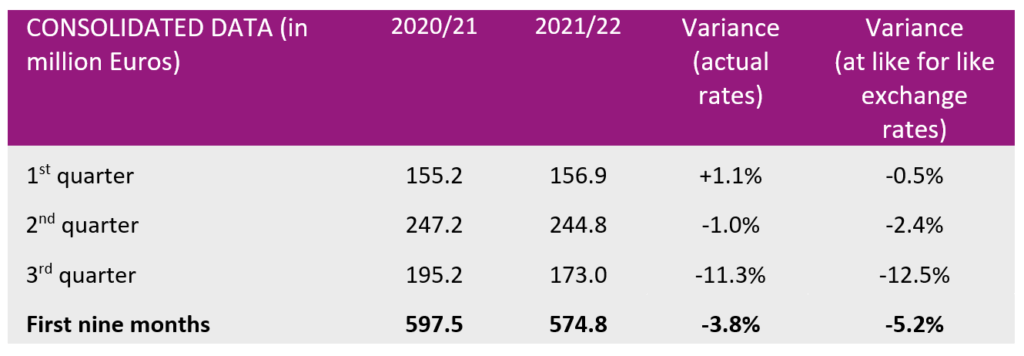

Damartex closed the third quarter with sales of € 173.0 Mn, down -11.3% at actual exchange rates (down -12.5% at like for like exchange rates) compared with the third quarter of the previous financial year. The Group’s business is suffering from record inflation, particularly in the UK and Germany, leading to a contraction in consumption. The base effect is also unfavourable: the third quarter of 2020/21 saw a strong recovery in demand, with, as a reminder, a +20.8% growth in turnover compared with €162.1 Mn in the 3rd quarter of 2019/20.

Building on a customer base that had been built up with 1.4 million new customers in the first half of the year, Damartex added 525,000 new customers in the third quarter. This is a slowdown compared to the third quarter of 2020/21 but an increase of 25,000 new customers compared to the same quarter pre-covid.

For the first nine months of the financial year, Damartex’s sales were down by -3.8% at actual exchange rates (-5.2% at like for like exchange rates) to € 574.8 Mn.

Sales for the “Fashion” division came to €432.7 million for the first nine months, stable against the last financial year (-0.8% at actual exchange rates, -1.9% at like for like exchange rates). In the third quarter, sales shrunk by -7.5% at actual rates (-8.6% at like for like exchange rates).

Over the quarter, the Xandres brand performed well, with very strong growth of +44.6% at actual and like for like exchange rates, driven in particular by the dynamic Belgian market and the brand’s positioning. Arbitrage on consumption impacted Damart and Afibel, respectively down -8.7% at actual rates (-10.0% at like for like exchange rates) and -12.6% at actual and constant rates over the quarter.

Sales for the “Home & Lifestyle” division came to € 117.2 Mn, down by -15.0% at actual exchange rates (-17.0% at like for like exchange rates) over the first nine months. Sales for the third quarter amounted to € 37.0 Mn, (-24.2% at actual exchange rates, -25.6% at like for like exchange rates).

This decline is explained in particular by the impact of inflation in the United Kingdom, which is at its highest level since the 1990s, on the Coopers of Stortford brand, and the strong base effect compared with the previous financial year. The company recorded a drop of -34.4% at actual rates over the quarter (-37.3% at like for like exchange rates), particularly marked on a very strong decline in e-commerce in the sector.

Finally, the “Healthcare” division, which includes the Sedagyl, Santéol and MSanté brands, reported sales of €24.9m, confirming the good momentum of the business with growth of +5.5% at actual exchange rates over the first nine months (+4.5% at like for like exchange rates). For the quarter, the business stabilized at +0.3% at actual exchange rates (-0.5% at like for like exchange rates) with sales of € 8.2 Mn.

Outlook

The deteriorated economic environment is prompting the Damartex Group to accelerate its development and pursue the transformation actions that are part of its Transform to Accelerate 2.0 strategic plan.

The Group is not directly exposed to the Ukrainian conflict. However, in this geopolitical context, which is likely to affect the global economy and accentuate inflation and supply tensions over the coming months, the Group anticipates a negative impact on its results and remains cautious as to the evolution of the situation.

The Damartex group announces the acquisition of 100% of the shares of the company JP Consult by the company Santéol Holding. This operation, like that of Perf R in Île de France recently, is part of the group’s transformation plan: “Transform To Accelerate – TTA 2.0”.

JP Consult is a home health care provider (PSAD) specialising in respiratory assistance and based in Mouroux, Ile de France.

JP Consult was founded in 2012 by Michel Crépin and has achieved a turnover of nearly €1.2 million in 2021 thanks to the trust of more than 2,000 patients who recognise the quality of service and the responsiveness of the teams in place.

This merger will enable Santéol to develop its activity in the Centre-East of France due to the presence of JP Consult in 5 departments in this region. Through the growing demand on the market, this operation is in line with the group’s ambition to become the European leader in the Silver economy, and illustrates Damartex’s desire to strengthen its Healthcare division.

With his expertise in this sector, Michel Crépin will take over the management of the Santéol Bourgogne Franche-Comté agency to accelerate this development.

With the integration of JP Consult, Santéol continues its geographical expansion and now covers most of France. The company is reinforcing its position as leader with nearly 17,000 patients cared for and a network of agencies allowing for ever greater proximity.

The integration of JP Consult in the accounts of the Damartex Group will take place on 1 January 2022.

As part of its “Transform To Accelerate – TTA 2.0” transformation plan, the Damartex group announces the acquisition of 100% of the shares of the company Perf R by the company Santéol île de France.

The company Perf R, a home health care provider specialising in respiratory assistance, is based in Palaiseau in Ile-de-France.

Perf R was founded in 2011 by Kader Abdellaoui. The entity has achieved a turnover of nearly €0.8M in 2021 thanks to the trust of 1,100 patients who recognise the quality of service and the responsiveness of the teams in place.

This merger will strengthen Santéol’s presence in the Paris region. The Croissy-sur-Seine branch will host the Perf R teams.

Given his experience in the profession, Kader Abdellaoui will take over the commercial management of Santéol in France. The integration of Perf R in the accounts of the Damartex group will take place as of 1 January 2022.

Damartex expands its geographical coverage with the launch of Xandres, its affordable luxury brand on the German market.

Xandres is a leading Belgian fashion brand, synonymous with quality and attention to detail, and is already present in Belgium, Luxembourg and the Netherlands.

The Xandres collections are designed for women who appreciate classic and timeless fashion, in line with current trends. Since the 1970s, the brand has been dressing all women from size 34 to 56 with naturally chic items that fit perfectly.

On 16 February 2022, Xandres held a press conference at the Soho House in Berlin to introduce itself to German fashion journalists and to launch its communication campaign.

Xandres is proud of its partnership with Veronica Ferres, a renowned actress in Germany with 145,000 subscribers, and her 20 year old daughter Lilly Krug, also an actress and social network personality.

The collections will be offered through 3 distribution channels: the Xandres.de website, the market places: Zalando and Van Graaf, and the presence in multi-brand shops.

The Damartex group is pleased to support the brand in its internationalisation and to continue the development strategy of its Fashion division.

www.xandres.de – www.xandres.be

Ongoing development of the Healthcare division

As part of its transformation plan “Transform To Accelerate – TTA 2.0”, Damartex

group announces the acquisition of 100% of the shares of Optimum Médical by

the holding company MSanté. MSanté was acquired by Damartex in July 2021

to expand its Healthcare division in the infusion and nutrition sectors.

Optimum Médical, based in the South of France, is a home healthcare service

provider (so-called PSAD), also specialised in infusion and nutrition.

This transaction should enable Optimum Médical to grow strongly, in particular

by benefiting from MSanté’s support in treatments for chronic diseases.

In addition, MSanté and the Damartex group will provide all the levers in terms

of know-how and resources to accelerate Optimum Médical’s development.

This operation is fully in line with the Group’s transformation plan.Damartex is

extending its national geographical coverage for home health services and

strengthening its Healthcare division, which is made up of :

- Sédagyl, homecare products distributor, present in France and in England.

- Santéol, a home healthcare provider specialised in respiratory assistance,

present in France with a network of 6 agencies. - MSanté, a home healthcare provider specialised in infusion and nutrition,

present in France, in the West with 3 agencies, and now in the South with the

integration of Optimum Médical.

Optimum Médical, founded in 2017 by Sonia Zhar and based in Montpellier,

expects a turnover of nearly €1.5m in 2021. The company already benefits from

the trust of more than 800 patients who recognise the quality of service and the

responsiveness of the teams in place.

Optimum Médical will be integrated into the Damartex Group’s accounts from

1 October 2021.

Acceleration of Business in Line with the Transformation Plan

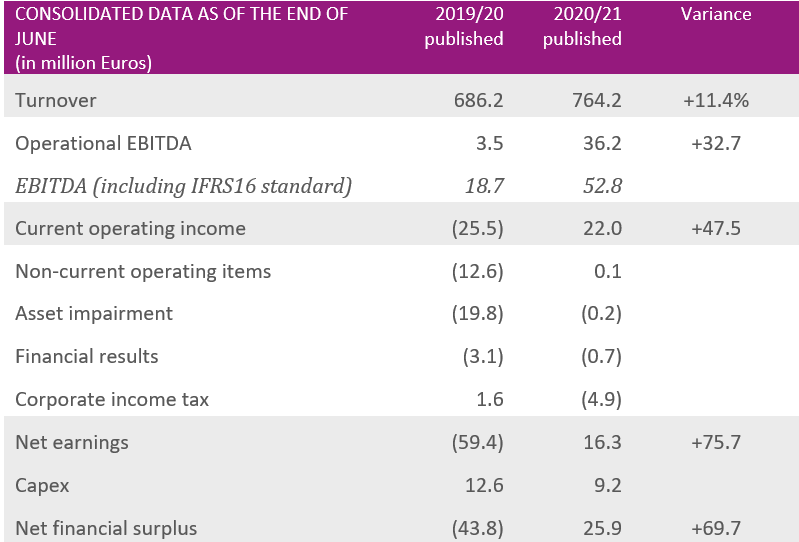

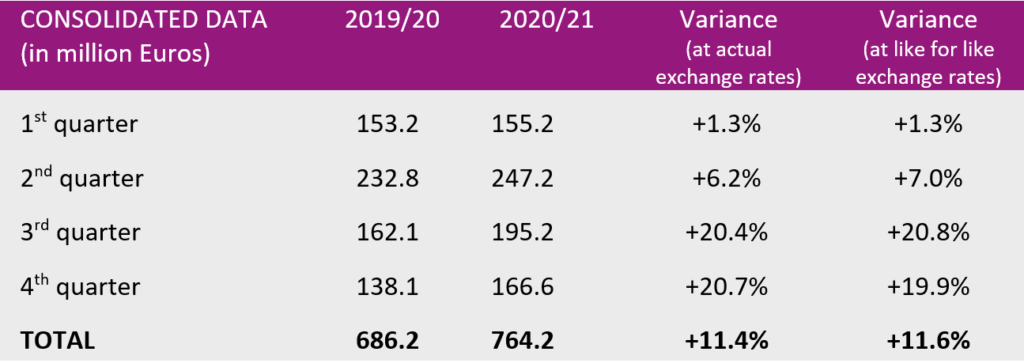

For the 2020/21 financial year, the Group’s sales amounted to € 764.2 Mn, an increase of +11.4% at actual rates compared with the previous financial year (+11.6% at like for like exchange rates). After an upward trend in the first half of the year, the second half of the year saw a good recovery in business despite the continuing health crisis, with an increase of +20.5% (+20.4% at like for like exchange rates) at € 361.8 Mn. As a result, the Group’s annual activity is up +6.1% compared with the 2018/19 financial year, a period not affected by the health crisis.

In the 3rd and 4th quarters, business increased significantly compared with the previous financial year at +20.4% and +20.7% at actual exchange rates. In addition to the favourable base effect, the performance of all divisions exceeded expectations.

In the course of the Financial year, despite the sale of the Jours Heureux brand and the discontinuation of the La Maison du Jersey and Delaby brands,

the “Fashion ” and “Home & Lifestyle” divisions have shown good resilience with increases of +11.0% and +8.3% respectively. The “Healthcare” division saw significant growth of +42.1% at €31.5 Mn.

Fashion division

Sales for the Fashion division amounted to € 555.1 Mn over the financial year, up +11.0% at actual exchange rates.

Over the financial year, Damart’s turnover increased by +14.9% at actual exchange rates at € 439.5 Mn, driven in particular by France and England. As part of its transformation, Damart successfully continues to adapt and modernize its offer.

Over the year, Afibel remained stable thanks to a last-quarter growth of +19.3%. The brand is benefiting from the initial effects of its repositioning and a new commercial strategy in England.

Home & Lifestyle division

The “Home & Lifestyle” division, dedicated to the comfort and well-being of seniors, grew by +8.3% at actual exchange rates over the year, with revenues of € 177.7 Mn.

The division’s growth was mainly driven by the very good performance of the Coopers of Stortford brand, whose business grew by +43.3% over the year at actual exchange rates. Vitrine Magique also experienced a strong acceleration in its sales in France, with an increase of +16.7%.

Healthcare Division

The “Healthcare” division, which focuses on home healthcare services (So called PSAD) and the distribution of homecare products, grew strongly during the year, with revenues up +42.1% at €31.5 Mn.

This increase was due to the integration of Santéol over the full year, the acquisition of Eden Médical in the Île-de-France region and the continued dynamic growth of Sedagyl, which rose by +24.8%.

In addition, on 20 July 2021, the Group announced the acquisition of MSanté, a home healthcare service provider (so-called PSAD) specializing in infusion and nutrition. The Group intends to eventually cover the entire country with Santéol for respiratory assistance and MSanté for infusion and nutrition, with the aim of accelerating the development of the Healthcare division.

In an unprecedented environment, the Group successfully continued to implement its “Transform To Accelerate TTA 2.0” transformation plan. The strong growth in e-commerce of +47.0% at €137.9 Mn, the development of new markets in the Healthcare and Home & Lifestyle divisions, and the turnaround in the Fashion division as a result of the ongoing modernization of the brands, confirm the strategy undertaken.

The marked increase in sales will have a positive impact on the result, without reaching the proportions of the first half of the year, as the Group has chosen to invest in a more favourable context.

As part of its transformation plan, “Transform To Accelerate – TTA 2.0”, the Damartex group announces the acquisition of 80.0% of the shares of MSanté by Damartex S.A.

MSanté is a home healthcare service provider (so-called PSAD), specializing in infusion and nutrition. It was created in 2013 by Stéphane Freche, who remains a shareholder in the company with 20% of the capital. The head office is located in Granville in the Manche département in France.

The team, made up mainly of nurses and nutritionists, is recognized by the main hospitals in western France, and coordinates the implementation of homecare programmes for over 2,000 patients. The company boasts a turnover of €1.5 Mn and 3 agencies, located in Caen, Nantes and Rennes (France).

In accordance with the integration strategy of the Damartex group, Stéphane Freche and his team will keep the management of the company autonomously in order to ensure its development, while benefiting from the skills and support of the Damartex teams.

DEVELOPMENT OF THE HEALTHCARE DIVISION

The Damartex group is thus strengthening its Healthcare division, which now consists of 3 brands in high-growth businesses:

- Sedagyl, a retailer of homecare products, which is present in France and in England. The expansion of the “health” product offering and the acceleration of digital technology are at the core of the company’s development;

- Santéol, a home healthcare service provider (so-called PSAD), specializing in respiratory assistance, and which is present in the Grand Est, Ile de France and Mediterranean regions of France, with a network of 6 agencies; and

- MSanté, a home healthcare service provider, specializing in infusion and nutrition, which is present in the west of France with 3 agencies.

For the home healthcare business, the Group’s aim is to cover the whole of France for the two brands separately, either through organic growth with the opening of new branches, or through external growth.

MSanté will be integrated into the Damartex Group’s accounts as of 1 July 2021.

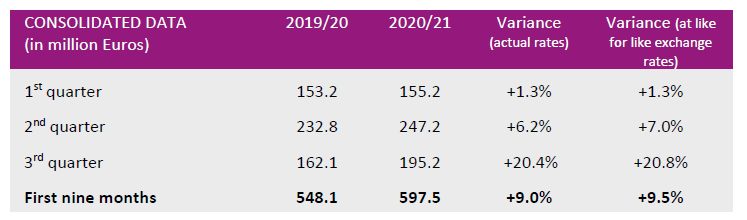

Acceleration of the Growth Momentum to +20.4% for the 3rd quarter

Damartex closes the third quarter with +20.4% growth at actual exchange rates (+20.8% at like for like rates) with a turnover of €195.2 Mn. This increase confirms the good business momentum observed in the first two quarters of the financial year, which were up +1.3% and +6.2% respectively at actual exchange rates. Although the Group benefited from a favourable base effect, this good performance was achieved in an economic context that remained deteriorated (with health measures, or closed stores in several markets). These good results reflect Damartex’s willingness to continue to invest in order to increase its turnover. This is particularly the case in the e-commerce channel, where the digital acceleration is reflected in a +75.6% growth in business over the third quarter and +60.9% for the first nine months of the year at actual exchange rates.

Over the first nine months of the year, Damartex has recorded a clear improvement in sales of +9.0% at actual exchange rates (+9.5% at like for like exchange rates) to € 597.5 Mn. This increase is significant in all divisions and all distribution channels.

Sales for the “Fashion” division came to €436.0 million for the first nine months, up by +5.6% at actual exchange rates (+6.0% at like for like exchange rates). In the third quarter, sales improved by +18.4% at actual rates (+18.7% at like for like exchange rates).

Over the quarter, growth was driven mainly by Damart, with growth of +29.5% at actual exchange rates (+29.9% at like for like exchange rates). This momentum demonstrates the positive impact of the modernization strategy and the marketing investments made. In France, sales rebounded by nearly +25% at actual exchange rates across all distribution channels (stores, mail order and web). In Belgium and the United Kingdom, business remained solid with increases of +20.1% and +50.2% respectively at actual exchange rates.

Afibel’s business, down -8.5% at actual rates over the last three months, continues to be impacted by its transformation. At the end of the period, the brand unveiled its new positioning accompanied by a media campaign whose first effects are expected in the next financial year.

Sales for the “Home & Lifestyle” division came to € 137.9 Mn, up +16.5% at actual exchange rates (+17.2% at like for like exchange rates) over the first nine months. Sales for the second quarter amounted to € 48.8 Mn, a sharp increase of +25.2% at actual exchange rates (+25.8% at like for like exchange rates).

This rebound can be explained in particular by digital and marketing investments aimed at highlighting the renewal of the offer and increasing the share of the Web in the sales mix. Thus, over the quarter, while Coopers of Stortford recorded growth of +75.3% at actual rates, the 3Pagen-Vitrine Magique brand increased its activity by +15.4% at actual rates.

The “Healthcare” division, which includes the Sedagyl and Santéol brands, posted sales of €23.6 Mn, up by a significant +40.1% at actual exchange rates (+40.7% at like for like exchange rates over the first nine months). For the quarter, sales rose by +28.4% at actual exchange rates (28.7% at like for like exchange rates) to € 8.2 Mn. This momentum is being driven by both brands, including Santéol, which has benefited from the effective integration of Eden Médical since 1 January 2021.

Outlook

The latest publications for the current financial year demonstrate the Group’s strong ambition, through the implementation of its strategic plan: “Transform to Accelerate 2.0” to return to growth thanks to a strong positioning in the silver economy segment.

The Group is continuing its efforts to implement its strategy to generate profitable growth. However, it remains cautious in view of the health situation which is still tense.