Turnover for the 2024/2025 financial year

Damartex stabilizes its business and continues its transformation efforts towards sustainable growth

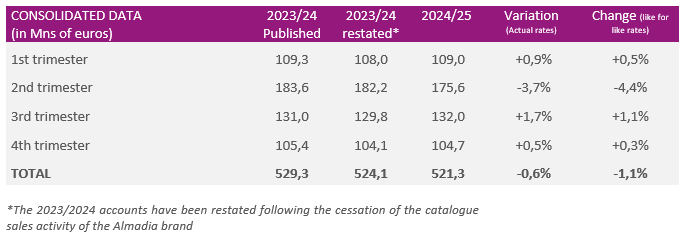

Damartex closed the 2024/2025 financial year with revenue of €521.3 Mn, almost stable compared to the previous year (-0.6% at actual exchange rates, -1.1% at like for like exchange rates). Despite a still adverse market environment, the Group’s three divisions confirm that their business is stable. In the second half of the year, the Group posted revenue of €236.7 Mn, up +1.2% at actual exchange rates (+0.8% at like for like exchange rates).

The fourth quarter was particularly buoyant for online sales, which posted positive growth momentum in each of the Group’s divisions. Damartex thus closed its last quarter with revenue of €104.7 Mn, up +0.5% at actual exchange rates (+0.3% at like for like exchange rates).

The “Fashion” division posted revenue of €389.4 Mn in the 2024/2025 financial year, down slightly by -1.7% at actual exchange rates (-2.2% at like for like exchange rates). The Damart brand was able to offer new ranges of innovative products to its customers, but remains penalised by a still deteriorating French market and closed the year with a slight decline in sales of -2.4% at real exchange rates. After a decline in the first six months due to the withdrawal of sales of underwear from the Thermolactyl range, the second half of the year recorded growth of +0.5% at real exchange rates. The Xandres brand continued its European development and posted solid performance, with sales up +5.7% at real exchange rates for the full year.

The “Home & Lifestyle” division benefited from positive demand, and posted revenue of €102.7 Mn, up +3.5% at actual exchange rates over the year (+2.6% at like for like exchange rates). The 3 brands in the division posted growth in their turnover over the year.

Finally, “Healthcare” revenue amounted to €29.1 Mn, up +1.6% at actual exchange rates. Santéol confirmed its trend of previous years and posted a +4.4% increase in sales at actual exchange rates over the year. Almadia is reaping the first benefits of the strategic repositioning of its services activities, with revenue almost stable over the year and growth of +2.5% over the last six months.

In a still deteriorating economic and commercial context, Damartex is maintaining the rigorous management of each of its activities, its costs and the proactive management of its cash flow.

In addition, the Group has entered into an agreement with its banking partners to extend its financing lines, the main features of which are: optimization of the lines with a reduction of €12.3 Mn, maintenance of financial conditions and a maturity date of August 3, 2027.

The Group is currently reviewing the ambitions of its Dare.Act.Impact 2026 strategic plan in order to take into account market trends and ensure sustainable growth in profitability.

At its annual results presentation on September 18, 2025, the Group will share the progress of the implementation and the next steps of its strategic plan