Sales for the 2nd quarter of the 2023/2024 Financial Year

Business in Line with Previous Quarters, First Steps in Rolling Out the New Strategic Plan

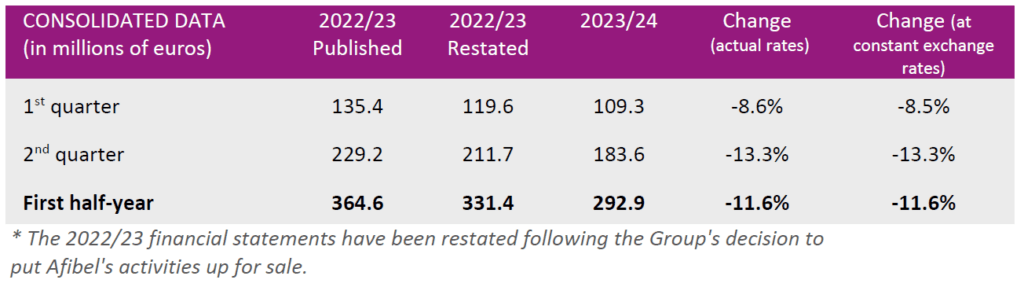

Damartex closed the first half of the 2023/2024 financial year with sales of €292.9 Mn, down -11.6% on the previous year at like-for-like and actual exchange rates. Against a resolutely unstable backdrop of persistently high inflation, declining purchasing power for both households and businesses, and weak economic growth, second-quarter sales came to €183.6 Mn, down -13.3% at like-for-like and actual exchange rates. The UK market in particular continued to slow down significantly, impacting the Group’s brands in this region.

In a declining market undergoing radical transformation, the Fashion division posted sales of € 226.7 Mn for the first half, down -9.9% at both actual and like-for-like exchange rates. Second-quarter sales were down -12.3% at actual exchange rates (-12.4% at like-for-like exchange rates).

The Damart brand reported a -13.1% fall in sales for the quarter at like-for-like and actual exchange rates compared with the same period last year. This trend is explained by the fall in footfall, as observed in the apparel market.

Xandres, positioned as an “affordable luxury” brand, once again put in a fine performance in the quarter, with sales up +9.0% at actual and like-for-like exchange rates.

The Home & Lifestyle division, impacted by a sector suffering from a loss of confidence and household budget cuts, ended the quarter with sales of €29.4 Mn, down -16.8% at actual exchange rates (down -16.9% at like-for-like exchange rates). Sales at 3Pagen and Coopers of Stortford, which are sensitive to the economic climate, ended the second quarter with sales down by -16.3% and -17.3% respectively at actual exchange rates.

The Healthcare division, which includes Almadia, Santéol and MSanté, posted second-quarter sales of €8.8 Mn, down -16.3% at both actual and like-for-like exchange rates, despite a good performance from the service business of the Santéol and MSanté banners, respectively up +15.5% and +15.8% at actual exchange rates. In line with the first quarter of the year, the division is temporarily impacted by the ongoing operational integration within Almadia, the new entity, resulting from the recent merger of the Sédagyl and Médical Santé brands.

In a market environment that is still uncertain and economic activity marked by a decline in household consumption, Damartex is continuing its tactical steering to adjust its level of activity to the macroeconomic context and is continuing to focus its efforts on rolling out its new Dare. Act. Impact 2026 strategic plan.

The Group is sticking to its commitments and continuing to manage its business with commercial agility and caution, both in terms of expenditure and cash flow.