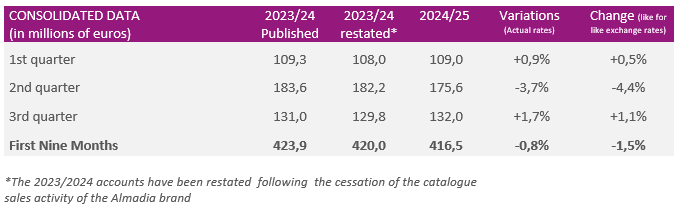

Revenue for the first nine months of the 2024/2025 financial year

Damartex confirms its trajectory despite a demanding context

Damartex closes the third quarter of the 2024/2025 financial year with revenue of €132.0 Mn, up year-on-year (+1.7% at actual exchange rates and +1.1% at like for like exchange rates). This performance confirms the resilience of the brand portfolio and the Group’s agility in the face of a turbulent macroeconomic context that is impacting consumer behavior.

Over the first nine months of the year, Damartex posted sales of €416.5 Mn, almost stable compared to the same period last year (-0.8% at actual exchange rates and -1.5% at like for like exchange rates ).

The Fashion division recorded revenue of €317.1 Mn in the first nine months, down -2.1% at actual exchange rates (-2.7% at like for like exchange rates).

In the third quarter, sales in this division were up +1.3% at real exchange rates (+0.8% at like for like exchange rates), driven by solid commercial momentum in February and March. Despite a downturn in January marked by a controlled withdrawal from the sales period due to the good management of its stocks, Damart closed with a positive quarter, thanks to a clientele that was ready for its new collections. While the Xandres brand posted a decline of -3.8% over the period due to better stock quality during the sales period and a new delivery schedule for multi-brand customers, the brand nevertheless maintained a sustained level of activity over the first nine months, up +3.6% compared to the same period of the previous year.

The Home & Lifestyle division confirmed its return to growth, benefiting from its operational and strategic evolution, and closed the first nine months of the year with revenue of €77.6 Mn, up +3.7% at actual exchange rates (+2.6% at like for like exchange rates). Over the last quarter, it stands at €26.1 Mn, up +3.0% at actual exchange rates (+2.1% at like for like exchange rates).

Finally, the Healthcare division posted revenue of €21.8 Mn in the first nine months of the year, an increase of +2.8% at actual and like for like exchange rates. In the third quarter, the activity of the division dedicated to healthcare grew by +2.6% at actual and constant exchange rates and ended the period at €7.3 Mn, still benefiting from the dynamism of Santéol. This performance testifies to the efficiency of our teams and the relevance of the strategic retargeting of Almadia’s service activities.

While the tense economic environment is impacting consumption, Damartex is nevertheless starting to reap the benefits of its transformation strategy, and intends to maintain its strict discipline in inventory management and cost management. The Group is therefore confidently continuing to roll out its Dare.Act.Impact 2026 strategic plan, to maintain this sustainable trajectory over the coming quarters.