Results for the First Half of the 2023/2024 Financial Year

Damartex continues to roll out its strategic plan with determination

BUSINESS

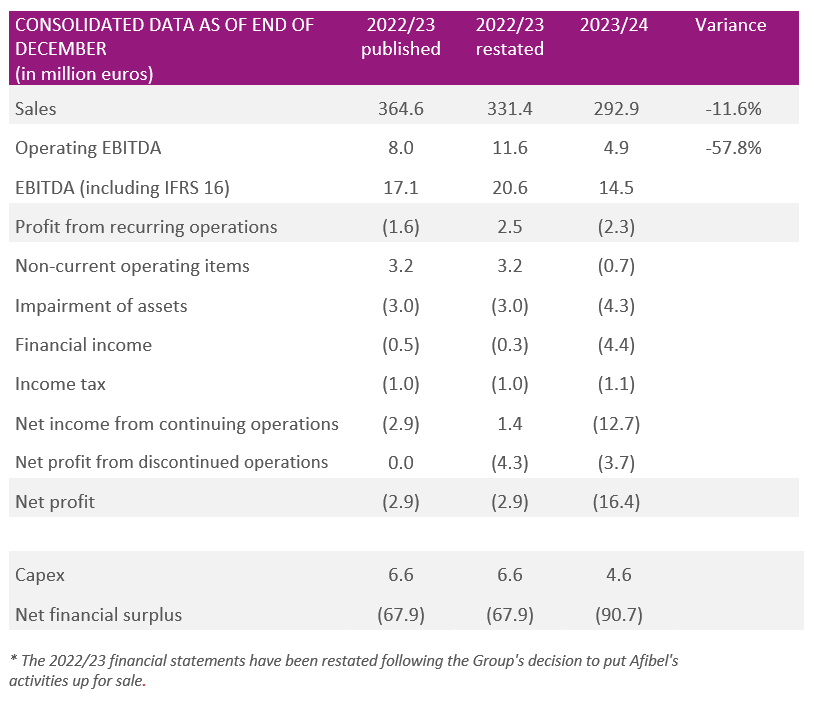

Damartex ended the first half of the 2023/2024 financial year with sales of €292.9 Mn, down on last year (-11.6% at actual and like-for-like exchange rates).

Sales for the Fashion division came to €226.7 Mn for the first half, down ‑9.9% at actual and like-for-like exchange rates, reflecting the impact of the deteriorated environment, despite another good performance from the Xandres brand (up +13.2% year-on-year).

The Home & Lifestyle division posted sales of €49.4 Mn, down -14.8% at actual and like-for-like exchange rates. This performance is currently being impacted by a commercial investment policy which is giving priority to a return to profitability, and by a market which is in decline as a result of a different trade-off in household consumption.

Finally, the Healthcare division ended the half-year with sales of

€16.8 Mn, down 22.4% at actual and like-for-like exchange rates. This figure reflects a mixed performance, with growth in the Home Healthcare sector (Santéol up +7.5% and MSanté up +3.1%) and a sharp fall in the Age-in-place sector (mainly due to a transition period dedicated to operational integration within the new Almadia entity).

DARE.ACT.IMPACT.2026 STRATEGIC PLAN

RESULTS

In an economic environment that remains unfavourable, the priority for the first half of the year was the implementation of the four-pronged DARE.ACT.IMACT.2026 plan.

Delivering financial performance:

Significant initial progress has been made in this area, with the aim of returning the business to profitability:

- Significant reduction in fixed costs with the implementation of the restructuring plan announced in September, which is already generating savings of €6 Mn on an annual basis ;

- Proactive management of inventories, both upstream (procurement) and downstream (clearing), resulting in a €20.4 Mn reduction over the first six months of the year ; and

- Optimization of marketing efficiency, thanks to better-targeted spending, resulting in a €12 Mn reduction over the half-year and an improvement in ROI.

The Group’s operating EBITDA came to €4.9 Mn, against €11.6 Mn last year, mainly as a result of the fall in business over the period.

Operating EBITDA was €6.8 Mn for the Fashion division, €-2.1 Mn for the Home & Lifestyle division and

€ 0.1 Mn for the Healthcare division.

Damartex closed the half-year with a net loss from continuing operations of €-12.7 Mn, against €1.4 Mn for the 1st half of 2022/2023.

Innovative brand experience:

Damartex is pursuing its objective of modernizing the image of its brands and improving the customer experience. The effectiveness of its investments is already being felt, as demonstrated by the significant rise in its NPS from 34.9 in Autumn-Winter 2022 to 48.5 in Autumn-Winter 2023.

In addition, the hybridization of the business model is continuing, with sales on marketplaces up +14.4% to €4.8 Mn in the first half.

Change Our World:

At the core of our business model, the Group is accelerating its CSR commitments, with significant progress in the proportion of products with a limited impact*, which, for the Fashion division, rose from 21.9% in SS23 to 37.2% in AW23.

Shared Leadership:

In line with its values and its transformation culture based on trust and responsibility, the Group has launched the Leadership Development Programme, which has already reached 30% of the Executive Leadership Team.

FINANCIAL POSITION

The net financial position was €-90.7 Mn as of the end of December 2023 (compared with €-81.9 Mn at the end of June 2023), reflecting the Group’s investments and its effective, reinforced management of inventories to adapt flexibly to changes in demand.

Working capital requirements stood at €33.3 Mn at the end of December 2023, compared with €40.6 Mn last year.

In line with its intention to focus its efforts and investments on a more limited number of brands, the Group has sold Afibel, its plus-size fashion brand.

OUTLOOK

Damartex is determined to continue optimizing its fixed and variable costs and actively managing its cash flow and working capital requirements.

Focused on customer satisfaction, the Group is continuing to invest in its growth and value creation objectives and, in an environment that remains uncertain, is beginning to see the fruits of its efforts.

* For the Fashion division, a product is considered to have a limited impact if it contains at least 30% more sustainable or labelled fibres, if its manufacturing process is more resource-efficient, or if it is produced in a European country with a low-carbon energy mix.