Results for the 2023/2024 financial year

At the end of Chapter 1 of its strategic plan, Damartex increases its operational profitability

PERFORMANCE BY POLE

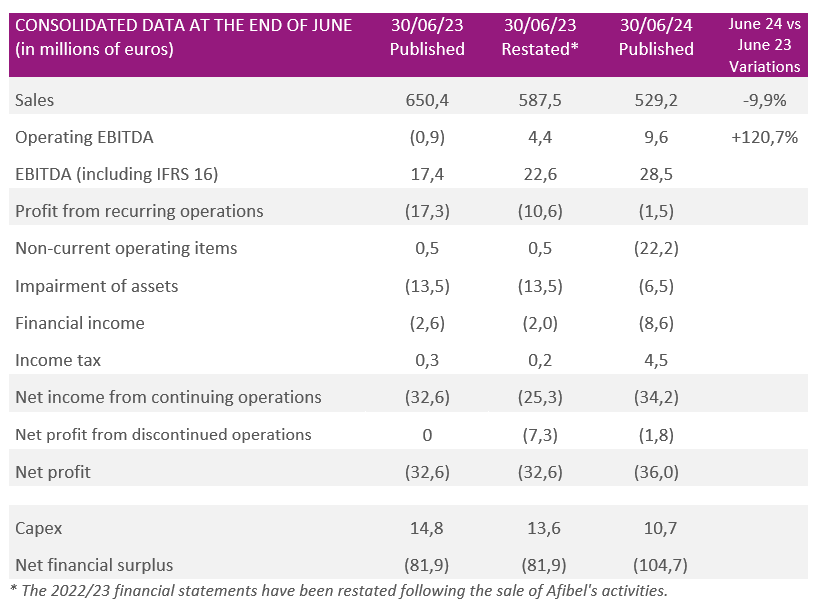

Damartex ended the 2023/24 financial year with sales of €529.2 Mn, down compared to the previous year (-9.9% at actual exchange rates, -10.2% at like for like exchange rates). This reflects activity impacted by headwinds (macroeconomic instability and contraction in consumption), but also more targeted business investments.

The “Fashion” division’s revenue amounted to €396.2 Mn for the 2023/2024 financial year, down -9.0% at actual exchange rates. While the Damart brand posted a decline in turnover, reflecting the evolution of its business model (decline in mail order, growth in market places and digital), the Xandres brand continues to demonstrate its potential with performances that are still strong (+6.8%).

The EBITDA of the Fashion division was €8.1 Mn, reflecting the solid fundamentals of Damart and the good performance of Xandres.

The “Home & Lifestyle” division recorded sales of €99.2 Mn, down -10.6% at actual exchange rates. The Group has significantly restructured the division’s business model to meet the challenges of a generally degraded market and changes in the sector.

EBITDA improved by more than €8 Mn compared to last year to end at -€0.4 Mn.

The “Healthcare” division posted sales of €33.7 Mn, down -17.9% at actual exchange rates.

Santéol and MSanté are performing well, in line with their ambitions. On the other hand, catalogue sales of Almadia brand’s home care accessories underperformed. As such, the Group is studying the project to discontinue this channel and a reorganization of the brand to focus its efforts on the pharmacy and service point channels.

EBITDA for the Healthcare division was €1.9 Mn, negatively impacted by

€2.7 Mn by the mail order business of the Almadia brand. MSanté and Santéol are growing in terms of rates and volume.

FINANCIAL RESULTS

Damartex’s operating EBITDA improved to €9.6 Mn, compared with €4.4 Mn last year, reflecting the adjustment of its activities and the fine management of its costs towards greater profitability.

The Group has implemented operational decisions and cost flexibilization measures that are already bearing fruit.

Damartex closed the 2023/24 financial year with a net profit of -€36.0 Mn, mainly impacted by non-recurring events such as the sale of Afibel and the restructuring undertaken within the Group, as well as by interest costs related to the financing finalized in August 2023.

FINANCIAL POSITION

The net financial position stood at -€104.7 Mn at the end of June 2024 (compared to -€81.9 Mn at the end of June 2023), taking into account the increase in the cost of financing, the above-mentioned exceptional transactions and the continued investments necessary for the Group’s transformation.

Working capital requirements stood at €24.8 Mn at the end of June 2024, a sharp improvement compared to the previous year. This result, the result of the efforts made by the teams, reflects the Group’s agility, particularly with regard to the sharp reduction of €25 Mn in inventories.

DIVIDEND

Due to a still difficult market environment, the Management Board will not propose a dividend distribution at the Annual General Meeting scheduled for November 21, 2024.

PROSPECTS

Still fully committed to its ambition to be a European reference in the Silver Economy, Damartex is engaging in Chapter 2 of its Dare.Act.Impact 2026 strategic plan, structured around four major complementary axes.

• Delivering Financial Performance: The 2023/2024 financial year was devoted to the implementation of a large number of restructuring actions with the aim of improving the operating profitability of each of the divisions. The ambition for 2024/2025 is to reap all the benefits of these restructurings and to accelerate the evolution of business models.

• Innovative Brand Experience : Priority focus for the 2024/2025 financial year. Across its three divisions, the Group will focus its investments on developing the image and influence of its brands to create a resolutely innovative customer-patient experience.

• Change Our World: Aware of its societal role, Damartex is accelerating its current momentum to achieve the ambition of reducing the carbon footprint by 25% by 2026.

• Shared Leadership : The year 2023/2024 has laid the foundations for a different kind of leadership, focused on autonomy and shared responsibility. The ambition for 2024/2025 is to continue the deployment of this innovative leadership to enable Damartex to be more adaptable.

“One year after the launch of its new strategic plan, the Damartex group has been able to make operational/structural choices and lay the foundations for its sustainable transformation, focused on a return to profitability. With the learning from the exercise, we are approaching the second chapter dedicated to the sustainable development of our activities with confidence and determination,” says Patrick Seghin, CEO of the Damartex group.