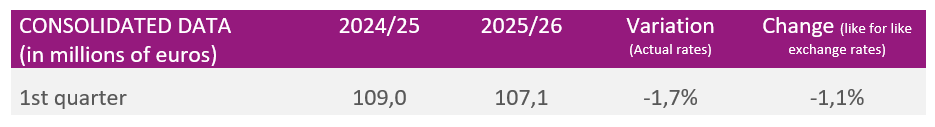

Q1 revenue of the 2025/2026 financial year

A resilient start to the financial year for the Group, which remains on track in a still mixed market environment

In the 1st quarter of the 2025/2026 financial year, the Damartex group posted sales of €107.1 Mn, almost stable at -1.7% at actual exchange rates compared to the 1st quarter of 2024/2025 (-1.1% at like for like exchanges rates). The Group maintains a rigorous and agile operational management in an unfavourable market marked by a certain wait-and-see attitude.

The “Fashion” division recorded revenue of €80.6 Mn in the 1st quarter, down slightly by -2.3% at actual exchange rates (-1.8% at like for like exchanges rates). Damart ended the first quarter down -3.2% at real exchange rates (-2.5% at like for like exchanges rates), impacted by a high basis of comparison and by consumption penalized by social movements in France. The brand nevertheless has a solid network, strengthened with the recent opening of its new store in Roubaix (at the brand’s headquarters), and continues to optimize the management of its sales channels.

Over the period, the Xandres brand continued its good momentum with sales up +3.2% at real and constant exchange rates, and focused on adapting its offer to each of its specific and buoyant markets.

“Home & Lifestyle” revenue was €19.3 Mn in the first quarter, stable compared to the same period last year (+1.2% at like for like exchanges rates). While Coopers of Stortford posted a decline of -8.2% due in particular to the ongoing adjustment of its marketing strategy, 3Pagen posted solid growth of +6.6% at real exchange rates.

Finally, the “Healthcare” division recorded revenue of €7.2 Mn over the quarter, almost stable at +0.9% at actual and constant exchange rates. The Santéol brand posted sustained activity, up +8.0% at actual exchange rates, driven in particular by the strengthening of the sales teams. Finally, Almadia, which is in the process of integrating the strategic evolution of its model, posted a -9.8% decline in revenue at real exchange rates. The brand is also temporarily penalised by the implementation of the regulatory reform of the full coverage of wheelchairs (scheduled for the end of the calendar year).

In the first quarter, Damartex continued the disciplined implementation of its Dare.Act.Impact 2026 plan, in a volatile macroeconomic and political environment. Supported by continuous innovation and with the satisfaction of its customers and patients as a priority, the Group remains focused on the smooth running of the activities of each of its divisions towards a return to sustainable growth.