Revenue for the 2023/2024 financial year

Damartex is pursuing its strategic course and agile management of its activities to achieve a successful turnaround

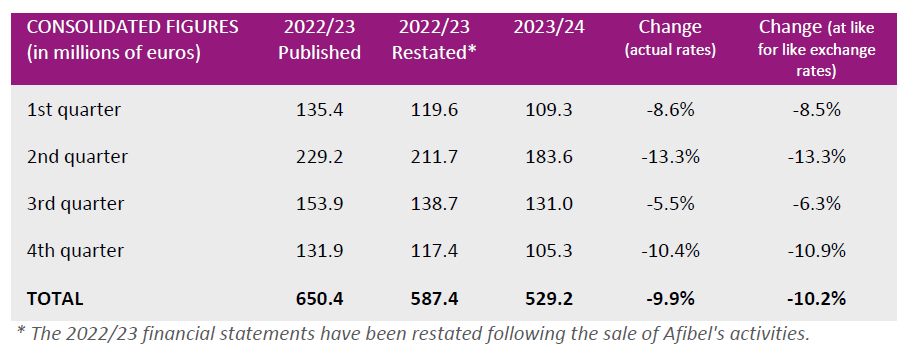

Damartex closed the 2023/2024 financial year with revenue of €529.2 Mn, down on the previous year (-9.9% at actual exchange rates, -10.2% at constant exchange rates). Continuing the trend of the first six months, second-half sales came to €236.3 Mn, down -7.7% at actual exchange rates (-8.4% at like for like exchange rates). This reflects both a business impacted by headwinds – macroeconomic and political instability and contraction in consumption – but also more targeted commercial investments.

The fourth quarter was particularly constrained for the Fashion and Healthcare divisions, while sales in the Home & Lifestyle division tended to stabilise. Damartex closed its final quarter with revenue of €105.3 Mn, down -10.4% at actual exchange rates (-10.9% at like for like exchange rates).

The “Fashion” division posted revenue of €396.2 Mn for the 2023/2024 financial year, down -9.0% at actual exchange rates (-9.3% at like for like exchange rates). With sales down -10.2% at actual exchange rates, the Damart brand was penalised by a drop in consumption, in particular due to poor weather conditions in the last quarter impacting the entire textile sector. The Xandres brand continued to prove its potential and the relevance of its positioning, with sales up +6.8% at actual exchange rates for the year as a whole.

The “Home & Lifestyle” sales for the year came to €99.2 Mn, down -10.6% at actual exchange rates (-11.1% at like for like exchange rates). While the 3Pagen brand is holding steady, Coopers of Stortford’s activity is down, in a context of persistent economic and political tensions in the English market. The Group has significantly restructured the division’s business model to meet the challenges of a generally degraded market and changes in the sector.

Finally, Healthcare revenue was €33.7 Mn, down -17.9% at actual exchange rates and -18.0% at like for like exchange rates. Santéol, a home healthcare provider specialising in respiratory assistance, closed a very dynamic financial year with revenue up +9.0% at actual exchange rates compared to the previous year. In addition, the division was particularly impacted by the underperformance of catalogue sales of homecare accessories under the Almadia brand. Faced with this challenge, the Group is looking into the possibility of discontinuing catalogue sales and reorganising the brand to focus its investments on the pharmacy and point-of-service channels.

Prospects

In a market environment that is still turbulent and given the many economic uncertainties, Damartex is maintaining rigorous cash management and careful and prudent management of its activities. While the Group continues to work on improving its operating profitability, it nevertheless expects a net profit for the year impacted in particular by exceptional items.

At its annual results presentation on September 11, 2024, Damartex will unveil the second part of its Dare.Act.Impact 2026 plan.